One beautiful morning you get up and you have dreams in your eyes. You are strategizing on your family future, education of your children, even your dream house. Yet what should happen in one moment, everything can become different? Life can be unpredictable. The reality is that we do not even know what tomorrow is going to bring.

It is here that life insurance comes in unobtrusively. It is not always about money but about love, care and guarding what you have created in dreams. Life insurance is not compulsory as many individuals believe. However, when reality hits it is the best armor your family can have.

Life insurance is so crucial since it assists in the insurance of your family in the absence of you. Being aware of the importance of life insurance can make you feel better. You can leave your family with money that is not taxed, thus they can purchase the day to day needs and major bills. Life insurance may also cover your home loan, car loan or any personal loan. In case you retire or quit employment, your individual life insurance covers your family. It has the ability to substitute the lost earnings to ensure that your loved ones live well and sustain their quality of life.

You need to be aware of why life insurance is important when you purchase life insurance. You choose the amount of money that your family will receive in case something happens to you. The insurance company will inquire with regard to your health, employment, and life. Answer truthfully. This assists them in determining the price and claims to come. Once your policy is passed, you are free to decide on the recipient of the money.

Test your life insurance frequently. The need to change may include paying off loans, getting married, having children, or even taking up a new job. Checking your policy will ensure the safety of your family and ensure that they have sufficient money.

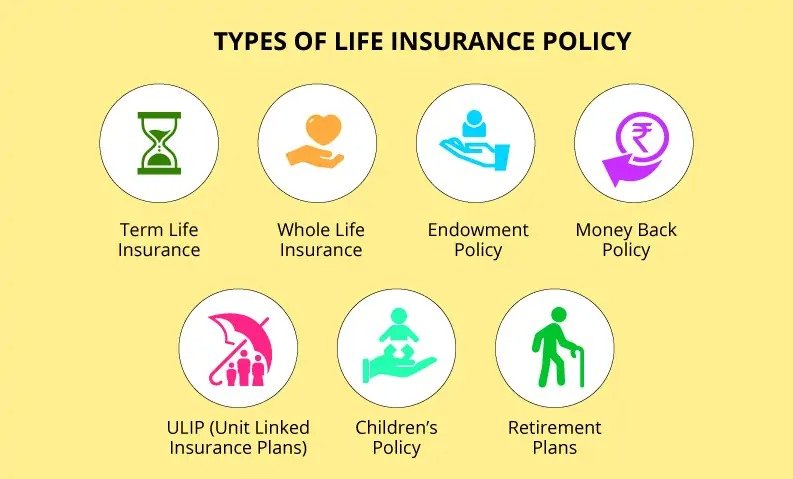

There are two major categories of life insurance, namely, term and permanent. By understanding what is the importance of life insurance, you will be capable of selecting the appropriate life insurance.

Term life insurance provides cover over a period of a specific duration, such as 10, 20 or 30 years. In case you pass away in the course of this period, your family receives money through the policy. The policy expires at the end of the term provided you live beyond that period.

Permanent life insurance is provided throughout your entire life. It will not expire until you cease to pay or cancel it. There are three common types:

Understanding why life insurance is important helps you protect your family and plan for the future.

Many people wonder why life insurance costs what it does. The price depends on a few things:

There are individuals who believe that life insurance is very costly. The fact is however that most people estimate it to be three times more expensive than it is actually. This may put families in jeopardy. This is because currently a healthy 30 year old can purchase a term life insurance policy at approximately 160 a year. That is only $13 a month.

It is also cheaper when you purchase life insurance at a tender age and in a healthy condition. This information about the importance of life insurance will help you realize that securing your family is not as difficult and expensive as others believe it to be.

Your children are laughing and playing as you are sitting with them. You have plans about them, a good school and a safe house and pleasant memories. But what will you do one day when you are not there to take care of them? Life can change in a moment. This is the reason why it is very crucial to know the importance of life insurance.

Life insurance is a kind of safety net to your family. It brings money now that you are away, so your kids can attend school, buy food and live without care. It assists your wife to retain the house and meet bills. It defends all your dreams that you had worked so hard to develop.

The reason why many individuals put off the issue of life insurance is that they believe that it is costly. However, it does not mean that you have to spend much to protect your family. Life always puts a twist and the slightest policy will help in saving a life. It is also knowing you can leave love and security behind though you may not be there to give it yourself to know why life insurance is important.

Your family believes that you can take care of them. One of the ways through which that promise can be kept is through life insurance. It is not about money, but about peace, safety, and love to the people that are the closest to your heart.

Knowing why life insurance is important can help you make smart choices. One key choice is deciding who will get the money when you are gone. This person or group is called a beneficiary. You can pick almost anyone: your spouse, children, partner, friend, a trust, or even a charity.

The people you choose should have something to lose if you were gone. This is called “insurable interest.” Your family and loved ones are the most common choices because they rely on you for money and care. Picking the right beneficiary makes sure your life insurance does what it is meant to do: protect and support the people who matter most.

Life insurance is not just about giving your family money. It is about love, care, and keeping your family safe, even when you are not there. Knowing why life insurance matters helps you see that it protects dreams, homes, education, and daily life. It gives your children a chance to grow up without worry and your spouse the peace to manage the home. Life insurance is a promise — a way to show your family you will always take care of them. It is more than money; it is safety, security, and love for the people who matter most.