Final expense insurance, also known as burial or funeral insurance, is a type of life insurance policy specifically designed to cover the costs associated with end-of-life expenses. These expenses may include funeral services, burial or cremation, and other associated costs like medical bills or unpaid debts. Unlike traditional life insurance policies, final expense insurance provides a smaller death benefit, typically ranging from $5,000 to $25,000, making it an affordable option for seniors or individuals who want to ensure their families are not burdened with these costs.

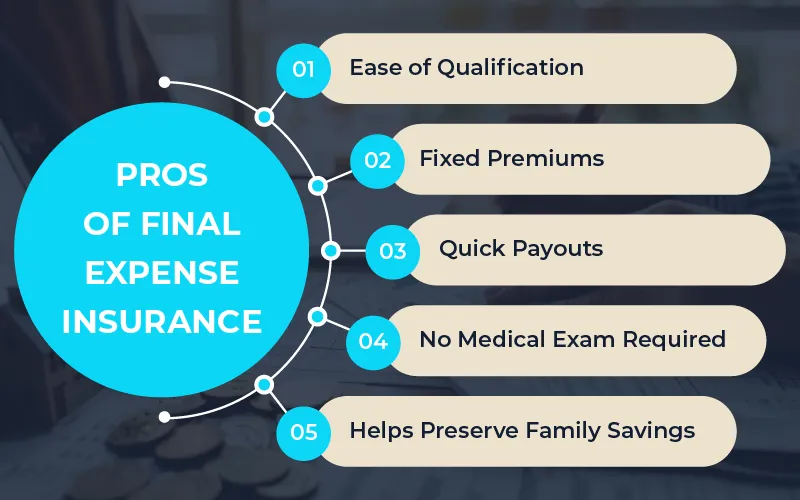

Final expense insurance offers several advantages for those looking to plan ahead for their funeral and burial costs. One of the most significant benefits is affordability. Because the death benefit is lower than traditional life insurance policies, the premiums are typically much more manageable, especially for seniors who may be on a fixed income. This makes it an attractive option for individuals who want coverage without the higher costs of larger policies. Another benefit is that final expense insurance often does not require a medical exam. Most applicants only need to answer a few health questions, making it easy to qualify, even for individuals with pre-existing conditions.

Final expense insurance works by providing a guaranteed death benefit to the policyholder’s beneficiaries upon their passing. The policyholder pays regular premiums, which remain level for the duration of the policy. As long as the premiums are paid, the coverage stays in place for life. When the policyholder passes away, the beneficiary receives the death benefit, which they can use to cover funeral costs, outstanding medical bills, or any other expenses. One of the key reasons final expense insurance is a smart choice for seniors is its simplicity and ease of qualification.

OLPolicy makes it easy to find the right life insurance by offering a wide range of policies in one convenient platform. Whether you are looking for term life, whole life, or final expense insurance, OLPolicy brings all the best options together. This simplifies the process of comparing different plans, helping you choose the one that fits your needs quickly and easily.

No need to go through multiple providers everything is accessible in one place.

This saves you time and helps you avoid getting overwhelmed by too many choices.

You can trust that the prices and details shown are accurate.

You can still secure a policy that provides financial protection for your loved ones.