Term life insurance is a type of life insurance policy that provides coverage for a specific period or "term," such as 10, 20, or 30 years. Unlike whole life insurance, which lasts for a lifetime, term life insurance only pays a death benefit if the policyholder passes away during the term of the policy. This makes it a straightforward and often more affordable option for individuals looking for temporary coverage. Term life insurance is especially popular with people who want to ensure their families are financially protected during critical periods, like when children are young or a mortgage still needs to be paid off. Once the term expires, the coverage ends unless the policyholder renews it or converts it into a permanent life insurance policy.

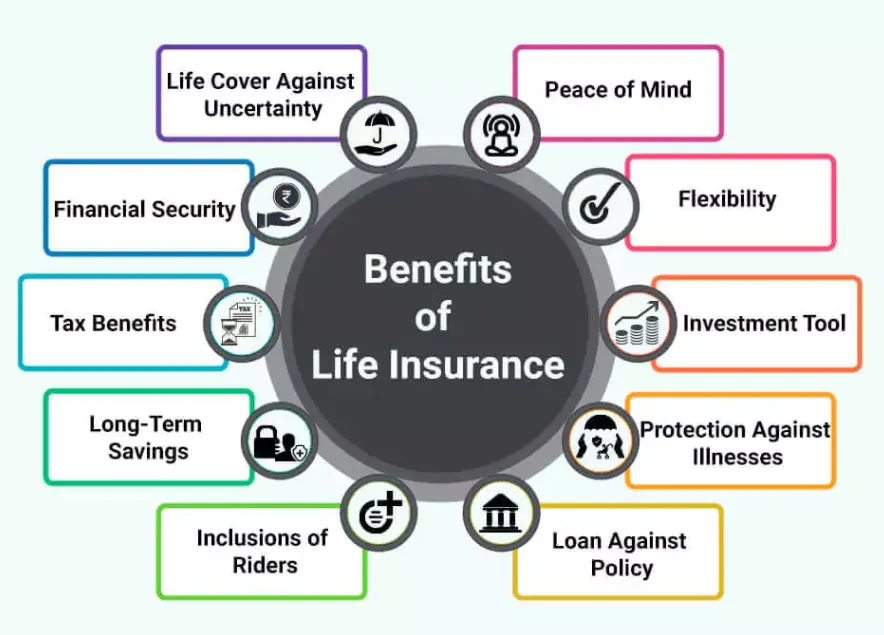

Term life insurance offers several key benefits, making it a practical choice for many individuals and families. One of the biggest advantages is its affordability. Since term life insurance only provides coverage for a set period and doesn’t build cash value like whole life insurance, the premiums are generally much lower. This makes it an accessible option for people who want significant coverage at a lower cost. Another important benefit is flexibility. Policyholders can choose the length of the term based on their specific financial goals or life stages. For example, you might choose a 20-year policy to ensure your family is financially protected until your children are grown or until the mortgage is paid off. Term life insurance is also easy to understand.

Term life insurance depends on various conditions. Here are few examples:

Are you a student, just entering the job market or facing your first financial obligations? Then you need financial security for a certain period of time. Then you can apply for term life insurance.

If you are a new parent or expecting a first child, term life insurance will give you financial security.

If you are a new entrepreneur this time will help you achieve your goals through hard work and dedication. Term life insurance can be taken for a short period of time after success.

Term life insurance works by offering coverage for a set number of years. During that time, the policyholder pays regular premiums, and in return, their beneficiaries will receive a death benefit if they pass away within the term. If the policyholder outlives the policy term, the coverage ends, and no death benefit is paid unless the policy is renewed or converted to permanent insurance. This type of insurance is ideal for people who have specific financial obligations for a limited period. For example, parents often buy term life insurance to ensure their family can maintain its lifestyle and cover expenses like education or home payments if they are no longer around to provide.

One of the main reasons term life insurance is so popular is its flexibility. The policyholder can select the length of coverage that matches their needs—whether it’s a 10-year plan to cover short-term debts or a 30-year plan to ensure long-term financial security. Additionally, since it doesn’t accumulate cash value, term life insurance tends to be much cheaper than whole life insurance, which means you can afford more coverage for less money. This is especially important for young families who may have significant financial commitments, such as raising children or paying off a mortgage, but may not have the budget for more expensive whole life policies.

For many, the simplicity and affordability of term life insurance make it a smart financial tool during critical life stages. Whether you’re looking to protect your family while your children are young, ensure financial stability during your working years, or cover debts like a mortgage, term life insurance offers peace of mind with straightforward, cost-effective coverage.