Being a sole proprietor brings together your business and personal cash. This implies that in case something goes wrong, there is a possibility that your own things are at stake. That is the reason why Sole Proprietor Business Insurance is so significant. It keeps you safe against surprises such as damage to property, lawsuits or minor things that turn into major issues. In this guide we will discuss the kinds of insurance you can be required to be covered, the cost involved as well as the companies that offer the best coverage.

When you run a business as a sole proprietor, you are personally responsible for everything your business does. There is no legal separation between you and your business. This means your home, savings, and even your car could be at risk if your business gets sued or suffers a big loss. Sole Proprietor Business Insurance protects you, not just your clients or equipment. Even a simple policy can help a lot if something goes wrong.

Think about this: A client visits your workspace and gets hurt, or you accidentally break their equipment. If your work causes them a loss, you are responsible. Without insurance, you would have to pay, and the costs can grow fast.

Even if you work from home, meet clients online, or run a small side job, the risk is still there. You may not see it coming, and that’s why insurance is important. It helps cover unexpected problems that could hurt you financially.

At the end of the day, Sole Proprietor Business Insurance is about protecting what you’ve built. You’ve put in time, effort, and money. One accident should not take it all away.

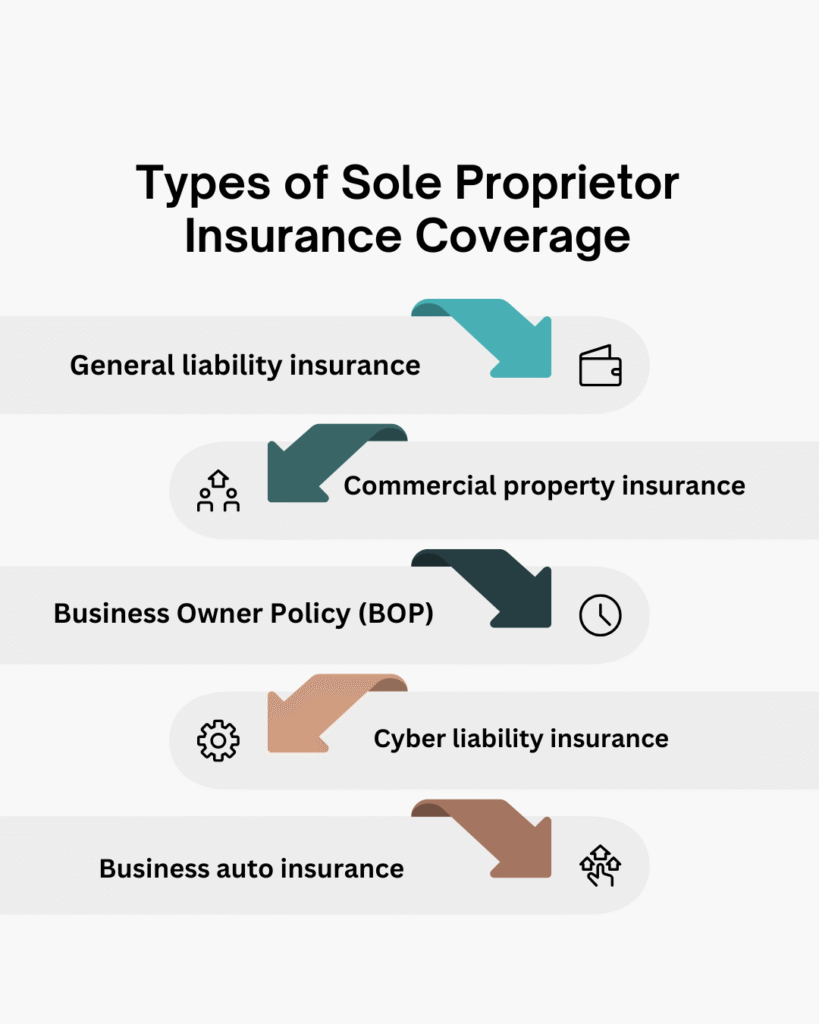

As a sole proprietor, you do it all, and that means you also take on all the risk. The good news? You don’t need many policies to stay protected. A few important types of Sole Proprietor Business Insurance can give you strong coverage.

Here are the main ones to think about:

General liability insurance is used to cover you against the common issues. In case a person is injured in your business or you damage their property, this insurance will be of assistance. As an example, when a client falls over the cord or you spill coffee on a laptop, the cost can be covered by Sole Proprietor Business Insurance.

Errors and omissions (E&O) insurance is also known as professional liability insurance, which helps to cover the claims brought against you by a client who claims that the work you did cost them money. This comes in handy with the freelancers, consultants, designers or anybody who provides advice or services. Under Sole Proprietor Business Insurance you can remain unaffected by such claims.

Commercial property insurance assists in protecting commercial owned items such as tools, equipment, inventory or workspace of your business. It can pay fire damages, theft or certain weather issues. Homeowner insurance might not cover business losses even in the case of working at home, which is common among regular homeowners. Sole Proprietor Business Insurance will ensure the safety of your business property.

A Business Owner Policy (BOP) is a general liability and general property insurance plan. This normally saves on the cost of purchasing them individually. You can also add business interruption or cyber cover on some companies. A BOP can provide you with good, simple coverage with Sole Proprietor Business Insurance.

Cyber liability insurance comes to your rescue in case your business information is stolen or compromised. This is significant when you store the information about your clients, when you collect the payments over the internet or when you run your business online. These risks can be covered using Sole Proprietor Business Insurance.

Business auto insurance is required in case you use your car to conduct business, such as making deliveries or paying your customers. The personal car cover may not meet these journeys. You can be insured on Sole Proprietor Business Insurance.

Choosing the right Sole Proprietor Business Insurance is not hard. The key is knowing what you need, not just what looks good on paper. Start with the basics like general liability and professional liability, then think about your tools, work location, and risk comfort.

| What to Consider | Why It Matters | Example / Tip |

| Type of Work | Different jobs have different risks | A web designer may need professional liability. A handyperson may need property or tools coverage. |

| Where and How You Work | Your work location affects coverage | If you work from home, visit clients, or sell online, make sure your insurance covers it. |

| Client or Partner Requirements | Some clients require proof of insurance | You may need general or professional liability to meet contract rules. |

| Financial Comfort Zone | Deductibles and limits affect cost | Higher deductibles lower premiums but cost more if something happens. Check your policy limits. |

| Policy Flexibility | Your business may change | Seasonal or part-time work may need a policy you can pause or adjust easily. |

At the end, the right Sole Proprietor Business Insurance is the one that fits your work, protects your risks, and gives peace of mind. Get quotes, read the details, and ask questions before you decide.

The cost of Sole Proprietor Business Insurance can be very different. It depends on your job, where you work, and how much coverage you need. Some people pay a few hundred dollars a year. Others may pay a few thousand.

Here are average yearly costs by profession:

| Profession | Coverage Limit | Estimated Annual Cost |

| Freelance Writer | $1M per claim / $2M total | $300 – $700 |

| Web Designer | $1M per claim / $2M total | $350 – $1,000 |

| Marketing Consultant | $1M per claim / $2M total | $400 – $1,200 |

| Photographer | $1M per claim / $2M total | $500 – $1,600 |

| Personal Trainer | $1M per claim / $2M total | $400 – $1,800 |

| Handyperson | $1M per claim / $2M total | $900 – $2,500 |

These are rough estimates. It is the precise price based on your company, location, and risk. The most appropriate way of knowing is through quotes. This is a good starting point of Sole Proprietor Business Insurance.

All of the sole proprietorships are unique, and the insurance companies consider a lot to determine your price. Prices can be very different even on two businesses within the same field.

Here are some key factors that affect Sole Proprietor Business Insurance costs:

Knowing these factors can help you get the right Sole Proprietor Business Insurance at a fair price.