Many renters assume their jewelry is automatically protected under their standard renters insurance policy. But here’s the truth: while renters insurance does offer some coverage for jewelry, it usually comes with strict limits often as low as $1,000 to $2,500. That means if your engagement ring, gold chain, or luxury watch is stolen or lost, you might only get a fraction of its actual value. Understanding how renters’ insurance jewelry coverage works is the first step in protecting your valuables.

In this blog, we’ll explain what’s included, the typical coverage limits, how to increase protection, and when you might need a separate jewelry insurance policy.

Most standard renters’ insurance policies include personal property coverage, which protects your belongings, including jewelry, from specific risks. This means that if your jewelry is stolen during a break-in or damaged by a covered event like a fire, you can usually file a claim. However, jewelry is treated as a “high-value item” and falls under special limits within your policy.

The biggest limitation is the payout cap. In most renters’ policies, jewelry coverage is restricted to about $1,000 to $2,500 total, regardless of how many items you own. For example, if your $6,000 wedding ring is stolen, your insurer may only reimburse you up to $1,500. This creates a significant gap between the item’s value and what you’ll actually receive, making standard coverage insufficient for valuable pieces.

Renters insurance typically covers jewelry for specific named perils, such as theft, fire, vandalism, or certain natural disasters like windstorms. However, coverage does not usually extend to accidental loss (e.g., misplacing your ring at the gym) or wear and tear over time. It’s important to read your policy carefully so you know exactly which risks are included and which ones require additional coverage through a rider or separate jewelry insurance policy.

Renters insurance usually won’t cover jewelry that’s simply lost or misplaced. For example, if you take off your engagement ring at the gym and forget it in the locker room, your standard policy won’t reimburse you. This is considered negligence or accidental loss, and it requires a separate jewelry rider or a standalone jewelry insurance policy for protection.

Insurance is designed to protect against unexpected events, not natural aging. If your necklace’s clasp breaks over time or a gemstone loosens due to everyday use, renters insurance will not cover repairs. Wear and tear, gradual damage, or maintenance issues fall outside of standard coverage.

Even if the cause of loss is covered (such as theft or fire), your renters insurance will only pay up to the policy’s jewelry limit, usually $1,000 to $2,500. That means if your $10,000 diamond bracelet is stolen, you’ll still face a major out-of-pocket loss. Without scheduling your jewelry or buying separate coverage, high-value items remain underinsured.

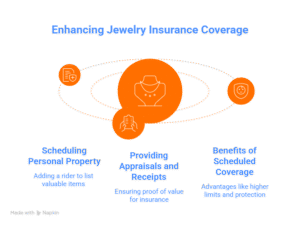

The most common way to expand coverage is by scheduling your jewelry on your renters’ insurance policy. This means adding a rider or endorsement that specifically lists each valuable item, along with its appraised value. Scheduled jewelry is protected for its full replacement cost, rather than being limited by the standard $1,000–$2,500 cap.

Insurance companies usually require proof of value before approving additional jewelry coverage. This includes a recent professional appraisal, detailed photos, or purchase receipts. Keeping this documentation updated ensures that if you need to file a claim, the process is smooth and your payout reflects the item’s true worth.

Scheduled coverage offers several key advantages over standard renters insurance:

By scheduling your jewelry, you transform renters insurance from a basic safety net into a ro

bust protection plan for your most treasured items.

When it comes to protecting valuable jewelry, you have two main options: extending your renters’ insurance with a rider or buying a dedicated jewelry insurance policy. Each comes with its own pros and cons.

| Feature | Renters Insurance (with Jewelry Rider) | Separate Jewelry Insurance Policy |

| Coverage Limit | Typically capped per item, but can be raised with a rider | Often full replacement value with higher limits |

| Covered Risks | Theft, fire, vandalism, and some natural disasters may exclude accidental loss | Broader protection, including theft, fire, accidental loss, and mysterious disappearance |

| Cost | Generally lower, added to your existing renters policy | Higher, but tailored specifically to jewelry value and type |

| Claims Process | May impact your renters’ insurance premium if you file a claim | Specialized claim handling usually doesn’t affect other insurance premiums |

| Best For | Renters with only a few moderately valuable pieces | Owners of high-value jewelry collections or heirlooms |

If your jewelry is worth more than the standard renters insurance limit, you can purchase a scheduled rider (also called an endorsement).

A separate jewelry insurance policy may be a better choice if you own expensive or sentimental pieces.

| Option | Pros | Cons |

| Rider/Endorsement | Higher coverage, affordable, tied to a renters policy | May raise renters’ premiums if you file a claim |

| Standalone Jewelry Insurance | Broader coverage, no deductible, specialized claims process | Separate bill, sometimes higher premiums |

Renters insurance does cover jewelry, but usually only up to $1,000–$2,500. For valuable or sentimental items, adding a jewelry rider or choosing standalone jewelry insurance is the safest choice.

Final takeaway: If your jewelry means a lot to you, renters insurance alone isn’t enough; enhance it with extra coverage so you’re never left underinsured.

Disclaimer: This article is for informational purposes only and does not provide legal or insurance advice. Coverage details may vary depending on your insurance provider, location, and policy. Always review your renters insurance policy carefully and consult with a licensed insurance agent before making decisions about jewelry coverage.