Renters insurance in Miramar, FL is becoming essential for every renter who wants insurance coverage that protects personal property, limits financial risk and ensures stability during unexpected events. As Miramar continues to grow, more apartment buildings, rental homes and multi-unit communities require residents to understand how renters insurance works, what a policy covers and how to compare insurance company offerings before making a final decision.

This detailed guide covers everything renters in Miramar need to know, including coverage options, cost considerations, policy structure, how to get a quote and how to protect property from damage, theft, vandalism and other risks. It also highlights additional insurance products such as auto insurance, health insurance, life insurance and commercial auto coverage often bundled with renters insurance for a discount.

Renters insurance gives every renter reliable protection against property damage, liability claims and financial loss. Even though landlords must maintain their own insurance coverage for the building, their policy does not cover a renter’s personal property or financial responsibilities. This is why renters insurance remains one of the most valuable and affordable insurance products in Miramar.

A renters insurance in Miramar FL typically includes:

This coverage protects items such as electronics, clothing, furniture and valuable possessions. Damage from fire, theft, vandalism, unexpected leaks, or other covered events allows renters to repair or replace their property. Personal property protection is essential for anyone living in an apartment or rental home.

Liability coverage protects renters financially if they injure a guest accidentally or cause property damage. It helps cover medical costs, bodily injury claims and legal expenses. Even a small accident inside a rental can create significant financial risk, making liability one of the most important parts of a renters insurance policy.

If property damage makes your rental unlivable, renters insurance may cover temporary housing, meals and related expense. Unexpected events such as fire or severe water damage can force renters out of their home temporarily, so this protection reduces sudden financial stress.

Renters can get a quote or insurance quote through an insurance agent, insurance company website or insurance online tools. Whether you prefer OLPolicy agent, an agency, or another insurance company, comparing quotes helps you find the best coverage options and policy pricing.

When you get a quote, consider:

A renter who evaluates coverage carefully will make a stronger financial decision.

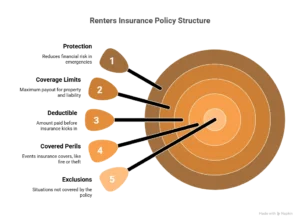

A renters insurance policy outlines coverage limits, deductibles, conditions and how claims work. Policies may differ depending on the insurance company, so understanding the details helps renters avoid confusion later.

A strong policy protects renters from high costs during unexpected circumstances.

Miramar renters experience a variety of property risks due to weather, building conditions and community activity. Common causes of rental property damage include:

Insurance helps renters repair property, replace items and avoid major financial loss. Whether it is small repair work or replacement of personal property, coverage ensures renters remain protected.

Cost is one of the most important factors for renters when selecting an insurance policy. Renters insurance in Miramar is affordable, especially when bundled with other insurance products.

What affects cost?

Renters should compare options based on their needs and budget to find a policy that offers strong protection without unnecessary expense.

Many renters bundle additional insurance products with their renters insurance, including:

Protects a vehicle from accident, collision, theft and other covered events.

Provides broader coverage for personal vehicles.

Protects a motorcycle from property damage, theft, or bodily injury liability.

Used for business-related vehicles.

Essential for medical care and financial protection.

Provides long-term financial protection for families.

Covers certain property-related losses beyond renters needs.

For individuals with business responsibilities.

Long-term financial planning options.

Bundling these insurance products often results in a discount and provides reliable coverage across multiple needs.

Renters insurance in Miramar protects against unexpected events including:

Coverage options vary, so renters should review the policy to ensure protection matches their lifestyle.

Insurance agents and agencies help renters understand coverage, compare options and find the right policy. A knowledgeable insurance agent explains terms, assists with claims and helps renters choose OLPolicy or other companies depending on their needs.

Good agents understand:

Whether you work with OLPolicy agent, another agency or choose OLPolicy for familiarity, professional guidance improves decision-making.

Apartment renters may experience higher theft activity or shared-wall water damage, while rental home tenants may face roof leaks, storm exposure, or larger repair needs. Renters insurance protects both apartment and rental home residents from property damage and financial loss.

Personal property coverage protects your possessions and helps renters replace damaged or stolen items. Whether you own valuable possessions, electronics, furniture, or appliances, protecting personal property is one of the most important features of renters insurance.

Renters insurance in Miramar, FL offers protection, financial stability and peace of mind for every renter. Whether you are comparing coverage, reviewing policy options, exploring insurance company offerings, or seeking an affordable solution that fits your budget, renters insurance provides essential protection for personal property, liability and unexpected damage.

By working with a qualified insurance agent or agency, reviewing coverage options carefully and bundling insurance products when appropriate, renters in Miramar can secure reliable, cost-effective insurance protection.