Miami’s palm-lined streets, high-rise apartments and ocean views make it one of the most attractive rental markets in the country. People move here for the weather, culture and nightlife, but renting in a coastal city also brings risks that many newcomers don’t notice until something goes wrong. From hurricanes and heavy rain to break-ins and building issues, renters insurance in Miami, FL plays a key role in protecting your belongings and your budget.

A lot of tenants think the landlord’s insurance policy will cover their belongings. In reality, the landlord’s insurance company only protects the building itself. Everything inside your unit—furniture, clothing, electronics and other personal belongings—is your responsibility. A standard renters insurance policy fills that gap and can help cover the cost of repairs or replacement after a covered loss.

Miami is located in one of the most active hurricane zones in the United States. Strong winds, heavy rainfall and power outages are a regular part of life. Older buildings may have plumbing or electrical issues that lead to sudden water damage, and some neighborhoods see higher rates of theft or vandalism.

Renters insurance can help protect your belongings from many of these unpredictable events. If your laptop is stolen while you’re at work, if smoke from a minor kitchen fire ruins your couch, or if a burst pipe soaks your bedroom, your renters insurance coverage can help pay for the loss instead of you paying out of pocket. In that way, renters insurance can help keep your finances stable even when the unexpected happens.

For many tenants, this is the right renters insurance because it offers peace of mind at a low monthly cost. If you’re unsure whether you need renters insurance, think about how much it would cost to replace everything you own. Most people realize very quickly that they do, in fact, need renters insurance to protect their belongings.

Despite all the risks, renters insurance remains one of the most affordable coverages in the personal insurance world. In Miami, most renters pay somewhere between twenty and thirty-two dollars per month, depending on how much personal property they insure, which deductible they choose and where the building is located.

Apartments near the beach or in low-lying areas may have higher premiums because the risk of damage is greater, especially during hurricane season. Newer buildings with secure entrances, cameras and upgraded electrical systems are viewed as lower risk and can qualify for better rates and renters insurance discounts.

Several factors influence your renters insurance premium:

Even when you choose broader coverage options, renters insurance in Florida is still a relatively low-cost way to protect thousands of dollars of belongings.

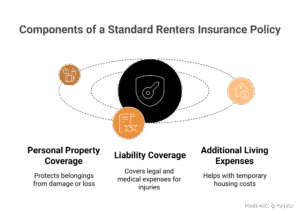

Most policies in Miami follow a similar structure. A standard renters insurance policy from a reputable insurance provider includes three main parts: protection for personal property, liability coverage and additional living expenses.

Personal property coverage helps pay to repair or replace your belongings when they are damaged by covered events such as fire, smoke, theft, vandalism or sudden water damage from a burst pipe. This can include:

Some policies also extend limited protection to belongings that are temporarily outside your home, such as a bike stolen from a rack.

Liability coverage is designed to protect you if someone is injured in your apartment and claims that you are responsible. It can help cover legal costs, settlement amounts and certain medical payments for guests. Many renters choose at least $100,000 in personal liability coverage, but higher limits are available if you want more protection.

If your rental unit becomes uninhabitable due to a covered loss—such as a fire or severe water damage—renters insurance may also help with loss of use. This part of the policy pays for temporary housing, meals and transportation while your apartment is being repaired. These additional living expenses can make a huge difference after a major storm or building emergency.

Even the best renters insurance has limits. One of the biggest gaps for Miami renters is flooding. Damage from storm surge, rising water or flooded streets is usually excluded from standard policies. To protect against those risks, you may need a separate flood insurance policy or coverage through the national flood insurance program.

Renters insurance also does not cover:

Understanding these exclusions helps you decide when to add extra insurance options or endorsements, especially if you live near the coastline or own high-value items.

More and more Miami landlords now require tenants to carry renters insurance. This is common in luxury towers, managed communities, student housing and furnished rentals. The lease may specify the amount of liability coverage you must carry and ask that the landlord be listed as an interested party on your renters policy.

Even in buildings where renters insurance is not required by law or by the lease, having your own policy is still one of the easiest ways to protect your belongings and avoid conflict with your landlord after a loss. It also shows that you are a responsible tenant who understands your insurance needs.

Because hurricanes are a yearly concern, many renters want to know how their policy responds to storm damage. In general, renters insurance may cover wind-related damage if wind is included as a covered peril. For example, if heavy winds break a window and rain ruins your couch, your insurance may help cover the cost to replace it. The policy may also respond if vandalism or theft happens around the time of a storm.

However, as mentioned earlier, storm surge and rising water are excluded from standard renters coverage. That’s why renters in flood-prone areas often look at separate flood insurance options to build a more complete protection plan.

There are several ways to lower the cost of coverage without sacrificing protection. One of the most effective strategies is to bundle renters insurance with auto insurance or car insurance from the same insurance company. Many insurers reward bundle renters with a noticeable discount.

You can also:

These steps make it easier to find affordable coverage while still meeting your insurance needs.

When you’re ready to shop for coverage, it helps to compare more than one insurance provider. Look at:

Most companies make it easy to get a renters insurance quote online. Many also let you get a free renters insurance quote today and see different coverage options before you decide. If you prefer speaking with someone, an insurance agent can explain the types of renters insurance available and help you find the coverage you need.

When you are comparing offers, remember that the best renters insurance is not always the cheapest one. The right balance between price, coverage limits and service matters more than saving a dollar or two per month.

Picking the right policy starts with understanding the value of your belongings and the risks you face where you live. Renters who live near the water might want to look closely at flood insurance options. Those with expensive electronics or jewelry may want higher limits or scheduled coverage. Families might prefer higher personal liability coverage to protect against larger claims.

Think about how much stuff you have, what it would cost to replace it and how long you could afford to stay in a hotel if your apartment became unlivable. Then use that cost information to decide on coverage limits and deductibles.

Whether you are new to Florida renters insurance or simply reviewing your current policy, taking the time to consider your insurance options now can save a lot of stress later.

Miami offers an incredible coastal lifestyle, but it also brings real risks that renters cannot afford to ignore. A well-designed renters insurance policy in Miami, FL can protect your belongings, provide liability coverage and help with living expenses after a covered loss. By comparing quotes, understanding what your insurance covers and filling any gaps with flood insurance or other add-ons, you can protect your belongings and enjoy life in Miami with confidence.