Many people ask, “Is Permanent Life Insurance Worth It?” For some, it feels like a smart safety net. For others, it seems like an extra burden.

Life insurance is a key part of personal finance. It offers protection, peace of mind, and support for loved ones. Still, many people overlook its value.

In this blog, we will explore whether life insurance is truly worth it. We’ll look at its benefits, options, and how it fits into financial planning.

Life insurance value starts with its basic features. It is a contract between you and the insurer. You pay regular premiums.

In return, the insurer promises a death benefit. This benefit is paid to your chosen nominees after your death. Life insurance gives your family financial protection and peace of mind.

People ask if life insurance benefits justify their cost. Getting to understand the many advantages creating an insurance policy brings to your life starts your decision-making process. Below are some of the key advantages:

Life insurance acts as a financial security net for your family’s future because you earn most of the household income.

Life insurance becomes essential to support your family when unexpected loss occurs since it helps pay funeral expenses and medical bills and covers daily costs.

Through life insurance you can ensure outstanding debts such as mortgages along with car loans and credit card bills get paid after your death. Your family will need to cover your final debts through their personal finances when you don’t have life insurance protection which leads to an enormous financial challenge. Many people think life insurance brings value because of its debt clearance capabilities.

An additional benefit of life insurance policies under specific jurisdictional policies includes tax advantages. Your life insurance death benefits will pass to your beneficiaries without tax implications because these payments come tax-free. The higher value you will obtain from your life insurance policy represents additional worth of your investment.

The underestimated advantage of life insurance is the comport it delivers to policyholders. You gain peace of mind when you ensure your loved ones will be financially taken care of no matter what happens to you. For numerous individuals life insurance offers a reassuring feeling that becomes an important asset in their lives.

Moving ahead with our discussion we need to examine whether life insurance benefits match your individual needs. Your situation will dictate the answer, and there are several factors to consider:

Your family’s survival requires your income that makes life insurance an essential investment. The financial ability of your family to pay for housing along with utilities together with food and other daily expenses depends on your continued existence. You need life insurance when your family would struggle without your income because this coverage provides financial protection that keeps their lifestyle going briefly after your passing.

Your age along with your health status matters in determining whether life insurance offers suitable value for your needs. A healthy younger person receives affordable life insurance premium rates when seeking coverage. It makes sense to buy life insurance coverage now when you are young because your premiums will remain lower compared to what you would pay when older or unwell.

Having ample savings and investments which can support your family’s future becomes a factor that lowers the importance of buying a life insurance policy. The majority of people maintain insufficient savings to protect themselves from every potential situation yet choose life insurance for added protection.

The essential funds provided by life insurance allow people to fulfill goals around college costs, business startup expenses and retirement comfort after their passing. Throughout lifetime planning life insurance serves its essential role specifically for customers who envision long-term financial success.

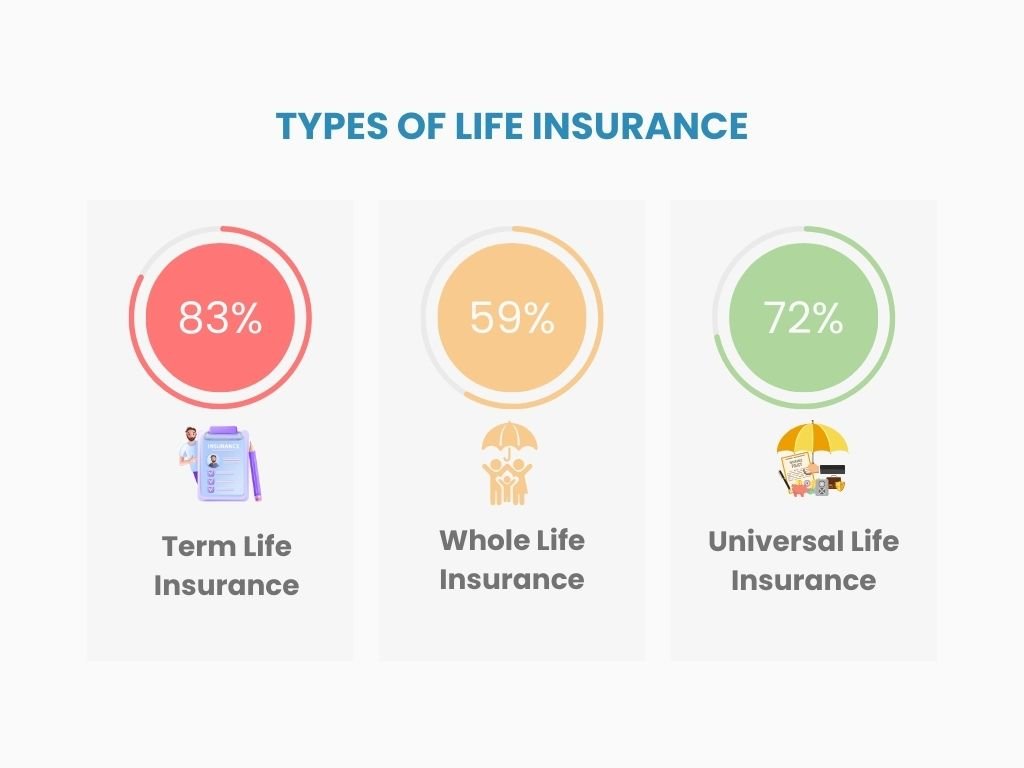

Life insurance presents two major questions for examination: its value and diverse policies types available. All life insurance plans have distinct properties which differentiate their value from one another. The different types of life insurance products all possess their own distinct characteristics and insurance benefits.

Among all insurance plans, term life insurance presents the simplest approach at affordable rates. People receive protection benefits through Term policies spanning 10, 20 or 30 years. Your beneficiaries obtain a death benefit when you pass away during the coverage term. Your coverage ends at term expiration benefits do not apply if you survive beyond the term limits. Young families will benefit regularly from term life insurance since it offers temporary coverage.

Whole life insurance creates a lasting solution because its benefits extend throughout an insured person’s entire lifespan. With whole life insurance you remain insured throughout your entire lifetime provided you pay your premiums. Whole life insurance policies create accumulating cash value through time that policyholders can utilize to handle withdrawals or maintain premium payment. Getting whole life insurance requires paying higher premiums than term life but remains appealing to people searching for continuous protection and account values yet wish to secure coverage through their entire lifespan.

Compared to whole life insurance universal life provides policyholders with greater adaptability during coverage term and premiums. This insurance product merges death benefit advantages with account value accumulation under rates established by the insurance company. With universal life insurance policyholders can modify their premium payments and death benefit amounts through customizable options which suit their ongoing needs.

One of the main concerns people have when considering life insurance is the cost. The question “Is Permanent Life Insurance Worth It?” often comes down to whether the premiums fit within your budget. However, the cost of life insurance varies based on several factors:

While life insurance can be an expense, it’s important to consider it as an investment in your family’s future. For many, the peace of mind and financial security life insurance provides makes it worth the cost.

There are a few common misconceptions that might make people question, “Is Permanent Life Insurance Worth It?” Let’s debunk some of these myths:

This is a misconception. Life insurance is just as important for young families as it is for older individuals. In fact, purchasing life insurance when you’re younger can lock in lower premiums and ensure your family is protected if the unexpected happens.

While life insurance premiums can vary, there are policies for every budget. Term life insurance, in particular, is often quite affordable, making it worth it for many individuals and families.

Employer-sponsored life insurance is often not enough to fully protect your family. It may only provide a basic level of coverage, and it’s typically tied to your employment. If you change jobs or lose your job, you may lose your life insurance coverage. Having your own individual policy provides better security and guarantees that your family is covered no matter what.

For many people, life insurance is indeed worth it in the long run. While it may seem like an extra expense today, the financial protection it provides to your family in the event of your death makes it a worthwhile investment. It ensures that your loved ones won’t face financial difficulties and can continue to live comfortably without your income.

Furthermore, life insurance is an important part of long-term financial planning. If you are considering saving for retirement or leaving a legacy for your heirs, life insurance can be an essential tool to achieve these goals.

Ultimately, the answer to the question, “Is Permanent Life Insurance Worth It?” depends on your personal circumstances, financial goals, and family situation. For most people, the peace of mind, financial security, and long-term benefits provided by life insurance make it a worthwhile investment.

If you are considering life insurance, take the time to evaluate your needs, explore different policies, and consult with an expert to ensure you’re getting the right coverage for your situation. In the end, the value of life insurance is not just in the dollars and cents but in the protection and security it offers to your loved ones.