Life is full of surprises. Basic life insurance can give your family some money if you are not there. But it may not pay for all needs like school, house, or doctor bills. Think about what your family really needs. A bigger plan may help more.

Firstly, Basic Life Insurance is a type of life insurance. This means it gives money to the people you choose, usually your family, if you pass away.

Not everyone can get it on their own. Often, Basic Life Insurance comes from work as part of benefits. These plans give a set amount of money when someone dies.

Sometimes, employees must pay a little or none at all. This is not a problem because the cost is usually low. Payments can come as a fixed amount or a small part of your paycheck.

One big benefit of Basic Life Insurance is that it is often guaranteed. This means you usually do not need a medical exam or health questions to get coverage.

This is very helpful for people with health problems. Normally, these issues could make insurance more expensive or hard to get.

Another good point is that Basic Life Insurance is cheap. You can get important protection without spending too much money.

But there are some downsides. The plan is not made just for you, so the coverage may be small. Also, if you leave your job, you may not be able to keep the plan or the benefits.

These types of insurance can give your family:

Basic Life Insurance is significant to secure your family. The cost is important as it makes you plan your budget and ensure that your family is safe.

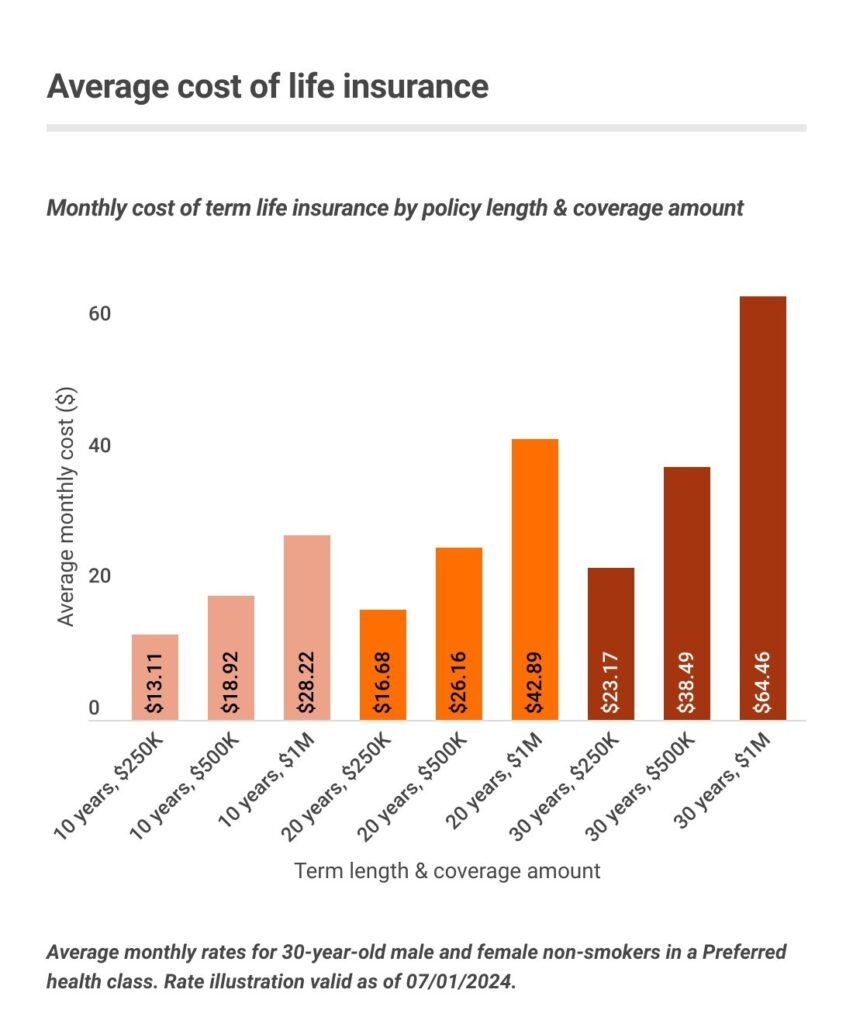

The cost of simple life insurance varies according to your age, health and size of coverage that you take. Generally, it is quite cheap and mostly among youth and healthy individuals.

Here are some common types and their cost range:

Even at a low price, Basic Life Insurance gives your family:

Basic Life Insurance is important because it helps protect your family and gives peace of mind. Employer-provided life insurance is useful for people who might not get private insurance or need extra coverage. It is simple and affordable, making it a good choice for many employees.

The cost of basic life insurance is usually low or sometimes free. Even if you pay a small amount, it is often much cheaper than private plans.

Here are some advantages:

Even at a low cost, Basic Life Insurance gives your family:

Basic Life Insurance is helpful, but it also has some drawbacks. Knowing these helps you make a better choice for your family.

Here are some disadvantages:

Even though basic life insurance is helpful, these disadvantages can leave your family at risk if:

Basic Life Insurance gives money to your family if you die. It is cheap and easy to get. You may not need a medical exam. Many people get it from work. It can help people who cannot buy private insurance.

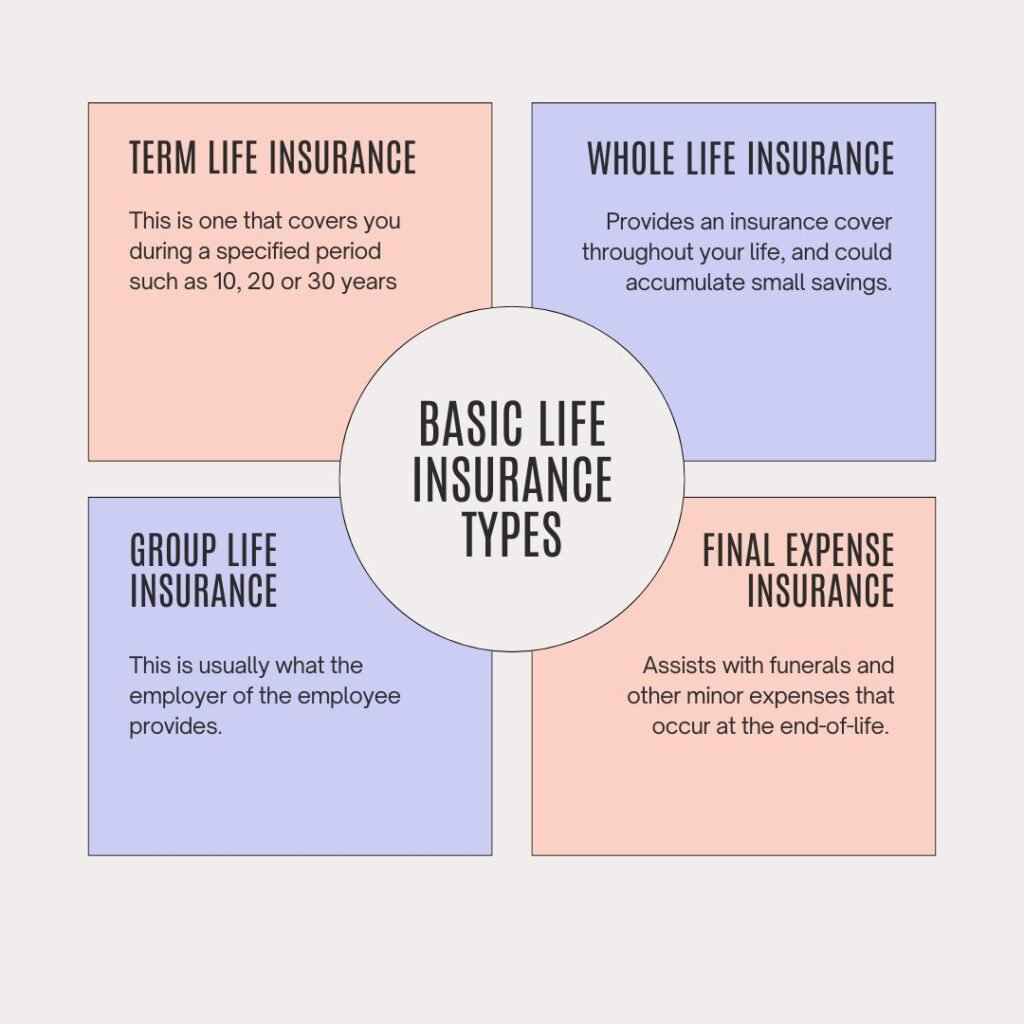

There are different types: Term Life, Whole Life, Group Life, and Final Expense. They help pay bills, school, loans, and other family needs.

The cost is usually low. It depends on your age, health, and how much coverage you choose. Some employer plans are free. They may also give tax benefits.

There are some problems too. If you leave your job, the coverage may stop. The plan may not fit all needs. Costs can go up.

Basic Life Insurance helps your family. But for full protection, you may need a bigger or an extra plan.