Thousands of employees are injured or ill every year due to their occupation. Virginia, in itself, records numerous injuries at work that need hospitalization and loss of work days. The law of Virginia provides that every employer who employs three or more workers should be insured by the Workers’ Compensation Insurance. This insurance provides injured employees with such benefits as medical attention and replacement of wages.

When you or a friend is injured at work, you might be asking yourself how much money you will be compensated and whether it is worth bringing a claim or not.

It may be difficult to make a decision on whether to claim some workers’ compensation insurance. It has numerous rules and procedures. It is prudent to discuss with an experienced workers’ compensation attorney. They are able to make you know your rights and go through the process with you so that you receive the benefits that you are entitled to.

Workers’ Compensation Insurance is mandatory law based in all states. It assists employees who sustain injuries or illnesses as a result of the workplace. This insurance covers the medical treatment, lost wages, and permanent injury money. The primary aim of the Workers’ Compensation Insurance is to safeguard employees. It ensures that employees receive the assistance and funds that they require following a work-related injury or illness.

Workers’ Compensation insurance covers the employees in case they become injured or ill due to their work. In case an employee is injured, the insurance company or the employer examines whether the injury is work-related. In the event it is, the medical care, lost wages, and other benefits are covered by the insurance.

In some cases, the assertion can be rejected. In such an instance, a workers’ compensation judge considers the claim and rules on what is fair.

Employers are also covered by this insurance. It avoids expensive litigation and offers financial assistance to sick or injured employees. Rehabilitation is also a benefit that can be paid by the workers and ensures that employees are able to recover and back to work safely.

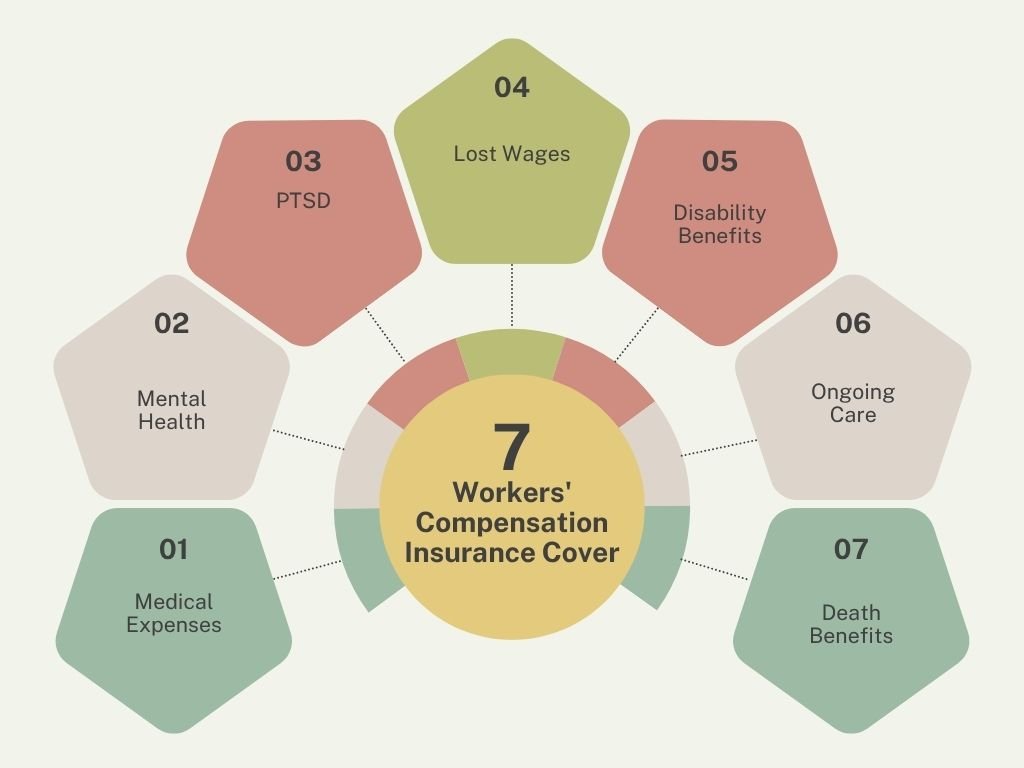

What Does Workers’ Compensation Insurance Cover?

Workers’ Compensation Insurance helps workers with many benefits when they get hurt or sick because of their job. Here are some of the main benefits:

These benefits are issued even in cases where the worker was partially at fault. The Workers Compensation Insurance also tends to bar its own employees in the event that they accuse their employers of inflicting injuries or illnesses at work.

Workers’ Compensation Insurance is designed to cover the majority of work-related diseases and injuries. However, there are cases that are not provided, and this can result in a rejected claim. These include:

Commuting: Injuries that occur when traveling to and from employment are not normally provided. You can be covered when you are in a business car or when you do not have a permanent office, such as a traveling salesperson.

Substance use or intoxication: In case the worker was intoxicated or on drugs, and this led to the injury, the claim can be denied.

Fighting at Work: Injury as a result of fighting with an employee may not be compensated. An exception would be whether the combat was over job matters.

Workers and employers are assisted by workers’ compensation insurance. Here are the main benefits:

Saves Money to Employers: In case an employee is injured or ill, then the insurance covers the medical expenses, the lost wages, and other expenses, such as the funeral costs. In its absence, the employer would pay.

Helps Workers When They Are on Extended Absences: When an illness or injury prevents a worker from attending work, the insurance will pay part of his/her wages. It also assists in covering such care as physical therapy.

Insures Employees regardless of a mistake made: Accidents do occur. Workers’ Compensation Insurance covers workers even in cases where the injury was a result of their own fault.

Workers Compensation Insurance is an insurance that is mandatory by the law and assists workers who become injured or sick at the workplace. It covers medical services, wages lost, rehabilitation, and even death benefits. Another benefit of this insurance is that it insures employers against expensive lawsuits.

It acts where the employer or the insurance company can prove that the injury is work-related. In case of denial of a claim, a judge may hear it.

Some of the benefits that shall be covered are medical expenses, lost wages, disability payments, mental health support, and serious injury or death.

There are also cases that are not covered, which include commuting accidents, injuries due to intoxication, as well as fights that are not work-related.

The key advantages are that it saves the employers money, assists employees in cases of extended absence, and covers workers in case they commit an error.

Workers’ Compensation Insurance covers both the workers and the employers and helps the workers receive the assistance and finances they require in case of an accident or disease at the workplace.