What is Commercial Property Insurance? Commercial property refers to the land or a building that is utilized by business. It may be a store, an office, a warehouse or a factory. It is significant to know what Commercial Property Insurance. Companies spend money on such properties. It is a lot to lose to protect them. Commercial property is subject to risk. It can be damaged by fire, theft and natural disasters. The insurance assists in covering the risks on the property.

Commercial property is of numerous kinds. Common types are retail shops, office space and factories. The needs and risks are varied in each type.

Simple measures can be used by businesses to safeguard commercial property. Maintenance, security and insurance are important.

Knowing what is commercial property will enable business people to make intelligent decisions. It ensures that the business is operating and secure.

One of such types of insurance is commercial property insurance. It insures business premises and real estate. It also insures item within such as machines, furniture, and stock.

It is highly important to know what a commercial property insurance is. There is no time when accidents do not occur. The property can be destroyed by fire, theft, flood or storm.

This insurance is used to pay up to restore or repair the property. The business owners will be left to pay out of pocket in case of in insurance.

Business property insurance provides a feeling of security. Owners can focus on work. They have the assurance that their property is safe.

it is quite important to know what constitutes commercial property and to be insured. It keeps business safe. It reduces loss. It assists in the running of businesses.

Business insurance is a commercial property insurance. It provides security to buildings, land, and items therein. This involves offices, stores, warehouses and factories.

Who Needs It? All business owners who are owners and renters of property require this insurance. There are small shops, big factories, office rooms, which are all at risk.

Why You Need It: Accidents and damages may occur at any time. Property may be destroyed by fire, theft, storm or flood. To repair these expenses is out of your own pockets without insurance.

Benefits of Having It

Risks of Not Having It

It is extremely important to know what is the commercial property insurance and possess it. It ensures safety of your business, less loss and allows you to concentrate on growth.

There are a variety of commercial property insurances. Being aware of what constitutes commercial property would keep your business safe.

Coverage Building Construction – Covers the building. These include walls and roof, floor and fixtures.

Business Personal Property (BPP) Coverage – Gives you business coverage on items that can be relocated. Equipment, inventory and supplies are insured.

Business Income Coverage (Business Interruption Insurance) – Covers lost earnings in case of business termination. It has the ability to cover rent, salaries and bills.

Extra Expense Coverage – Covers additional expenses to keep the business alive. As an illustration, hiring temporary office or equipment.

Equipment Breakdown Coverage (Boiler and Machinery Insurance) – Covers breakdown of machines or electricity. Advantageous to those companies with equipment or machinery.

One should understand what commercial property coverage entails. All of them protect some sphere of your business. Selecting the right coverage is ensuring that your business is safe.

Commercial property insurance protects business property. Knowing what is commercial property insurance is very important.

Fire – Covers damage from fire. Smoke damage is also included.

Windstorms and Hail – Covers damage from wind, hail, or storms.

Vandalism – Covers damage if someone breaks or harms your property on purpose.

Theft – Covers losses from theft or burglary.

Water Damage – Covers damage from burst pipes, leaks, or sprinkler systems. Floods usually need separate insurance.

Other Risks – Some policies cover explosions, vehicle or aircraft damage, riots, or civil unrest.

Always check what is commercial property insurance is carefully. Policies may have limits or exclusions. Knowing your coverage keeps your business safe.

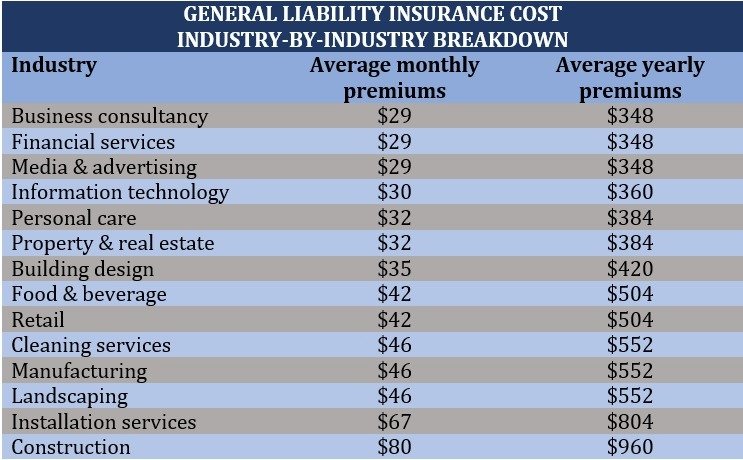

The cost of commercial property insurance depends on many things. Size, location, and type of business matter.

For Small Businesses: Small shops or offices usually pay less. Costs are lower because the property is smaller and the risks are smaller. Still, insurance helps protect money if something bad happens.

For Large Businesses: Big factories, warehouses, or office buildings pay more. They have more property and more risks. Insurance cost is higher, but it protects bigger investments.

Factors That Affect Cost

Even if the cost is high, insurance is cheaper than paying for damage yourself. Small or big, every business benefits from commercial property insurance.

| Business Size | Average Annual Premium | Monthly Premium Range | Example Industry |

| Small Businesses | ~$800 | $67–$140 | Retail Store, Office |

| Large Businesses | $2,000–$10,000+ | Varies | Manufacturing, Restaurant |

The commercial property is land or a building utilized in business. Examples include shops, offices, warehouses and factories.

Commercial property may be subject to fire, theft, storms and floods. The insurance assists in compensating damage.

It talks about building and items therein, including furniture, machines and stock.

Coverage is of various kinds. These are building coverage, personal property, business income, extra expense and equipment breakdown.

Businesses will lose money, become stressed, and cease to operate without insurance. Insurance prevents businesses out of business.