Employers have a popular choice of Large Group Health Insurance. It assists in insuring employees and their families at a reduced cost. Tax benefits are one of the major reasons why companies offer it. It is also a powerful weapon to attract and retain good employees.

Group health insurance is of two sizes small and large. There are advantages and disadvantages of each type. Their only major distinction is based on the size of the company. Big Group Health Insurance is offered to larger businesses. It provides larger coverage and in many cases is cheaper per employee.

Employers have some chance to compare small and large group plans to determine which one is more appropriate. The other possible alternative is a Health Reimbursement Arrangement (HRA). HRAs are flexible and cost-effective. The selection of the appropriate plan has the potential to safeguard the employees and help in business growth. Big Group Health Insurance is particularly useful to the companies that employ a lot of people.

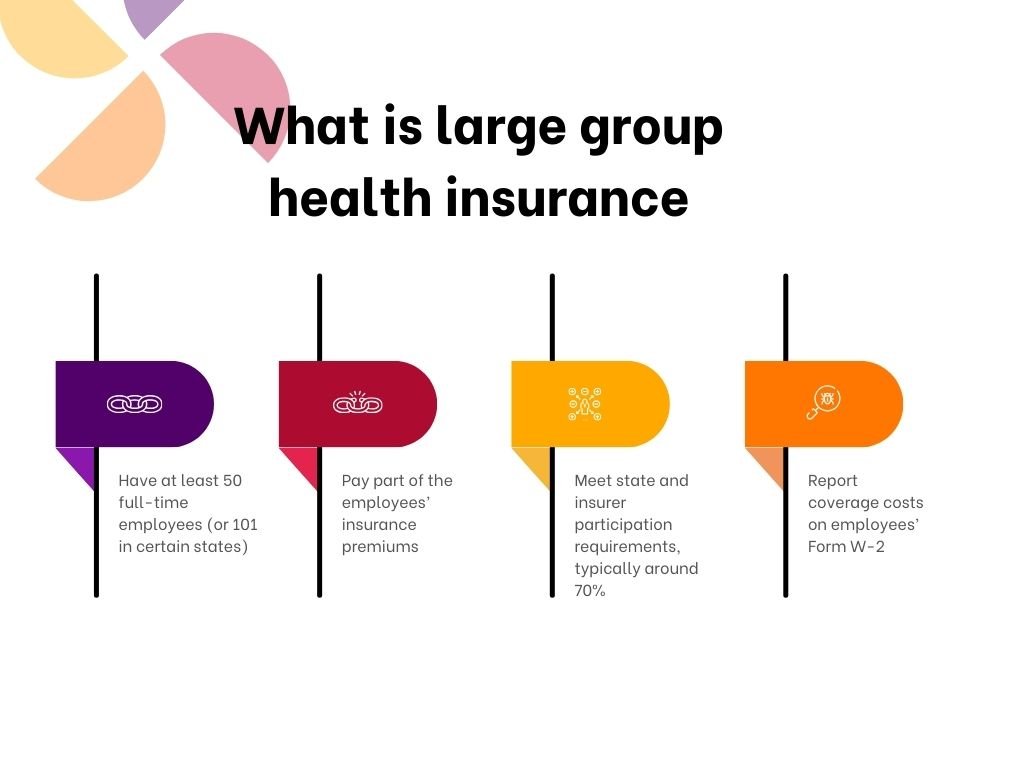

Big Group Health Insurance is structured to serve those companies that have numerous employees. Generally, companies employing 50 or more full time employees can qualify. These schemes cover the employees and their families. They are frequently cheaper per capita due to the fact that expenses are divided among a vast number of people.

Small group plans have fewer people whereas Large Group Health Insurance has wider choices. The benefits that an employer can offer include medical coverage, dental and vision coverage. The Affordable Care Act (ACA) also regulates such plans and makes necessary health benefits part of them.

Large Group Health Insurance is popular among large employers who seek to attract and retain the best employees. With a good benefits package, a company will be more competitive. Coverage is affordable and enticing since many big companies cover part of the premiums of their staff.

The requirements regarding participation are different, and the participation rates tend to be higher in large companies. Small group plans may be divided into tiers such as bronze, silver, gold, and platinum and so can insurers. Large plans also comply with the medical loss ratio requirement, and spend at least 80% of premiums on medical care.

To select a Large Group Health Insurance plan, employers may collaborate with insurance companies, brokers or agents. Open enrollment tends to be done on an annual basis, although there are some options that are annual round. These plans assist the companies in offering extensive coverage and contain expenses, ensure the wellbeing of employees and maintain a contented workforce.

Big Group Health Insurance is recommended in larger organizations. A large group of employees is taken to be 51 or more employees as viewed by most states as an employer. In certain states such as California, Colorado, New York and Vermont, the large group is defined as 101 employees and above.

Big employers (50 or more full-time equivalent employees (FTEs)) are required to offer affordable health insurance under the ACA. The coverage has to satisfy the minimum essential coverage (MEC) requirements and minimum value requirements. The non-compliant employers risk paying taxes as a penalty. To comply with these requirements most big employers opt to use Large Group Health Insurance.

To qualify for Large Group Health Insurance, companies must:

The key distinction between small and large group plans is the amount of employees. The large group plans are also less rigid. They do not have to rely on ACA metallic tiers and the additional benefits could be offered by the insurers at a premium.

Large group plans are required to pay out at least 85 percent of the premiums as medical care, with 15 percent of administrative cost. Employers may buy these plans at any time of the year, although, in most cases, employees enroll during an open enrollment or a special enrollment period. Large Group Health Insurance assists large companies in offering a full coverage and keeping the costs at a check and the employees happy and healthy.

Group health plans premiums are determined depending on a number of factors. Small group plans are very strict ACA. The insurers can merely take into consideration the age, family size, location, tobacco use, and plan type. Small employers are not able to bargain rates. The premium is fixed once and this can make coverage costly.

The large group health insurance is different. Insurers take into account even more issues including the amount of employees covered, the total coverage, the type of industry, the history of claims made by the company, and optional add-ons. Underwriting in large groups is done as one. It implies that all the employees are considered equal risk. Bargaining rates can be done by the employers or brokers and add-ons can offer discounts.

In order to know the costs, some averages. As reported by KFF, the 2023 average annual premiums of group health insurance are 8,435 on self-only and 23,968 on family coverage. The average payment made by employers on self-only plans was $7,034, and on family plans was 17,393.

In its breakdown, the average self only coverage of small businesses was 8722 and that of large companies was 8321. Small employers paid family coverage of $23,621, and large employers paid family coverage of 24,104. According to KFF, small businesses are those that have 3-199 workers and large companies have 200 or more.

The Large Group Health Insurance is more flexible and has more bargaining power. It enables large businesses to save more money and also provides comprehensive coverage. Employers can tailor benefits with large groups of employees, manage premiums and offer appealing health insurance plans to employees.

| Feature | Small Group Health Insurance | Large Group Health Insurance |

| Employer Size | 2–50 full-time employees (up to 100 in CA, CO, NY, VT) | 50+ full-time employees (101+ in CA, CO, NY, VT) |

| Employer Premium Contribution | Yes | Yes |

| Participation Rate | Typically 50%–75%; SHOP exception during Nov 15–Dec 15 | Typically 50%–75%; exceptions may apply |

| Essential Health Benefits Required | Yes | No |

| Metallic Tier Classification | Yes (Bronze, Silver, Gold, Platinum) | No |

| Medical Loss Ratio | 80% medical, 20% administrative | 85% medical, 15% administrative |

| Plan Purchase Timing | Anytime during the year | Anytime during the year |

| Premium Rate Determination | Age, family size, location, tobacco use, plan type | Age, family size, location, plan type, number of employees, claims history, sum insured, industry, add-ons |

| Rate Negotiation | No | Yes |

| Flexibility & Add-ons | Limited | High – optional ancillary benefits available |

Large Group Health Insurance is what comes to mind when employers are considering benefits. Even though it is inclusive of employees, there are certain disadvantages. It can also become less attractive over time due to increased rates on a yearly basis and a lack of flexibility. This is why other organizations have been resorting to flexible solutions such as HRAs.

An HRA is a health benefit that is approved by the IRS and is employer funded. It is a tax-free way that employers (large and small) reimburse employees on more than 200 qualified medical expenses. Individual plan premiums can even be reimbursed by some HRAs.

Employers do not have to deal with an insurance company but instead provide monthly allowance per employee. Workers cover their own deductibles. Then they provide evidence of purchases. Employers check them to ensure the compliance with IRS and reimburse to the allowance limit.

HRAs assist in the control of benefits budgets. Compared to Large Group Health Insurance, they do not raise the rates annually unless there is an increase in allowances. This is particularly handy to employers of any kind. There are tax benefits of HRA as well. Employers can claim tax-free reimbursements, and employees can claim tax-free ones provided that the rules are adhered to.

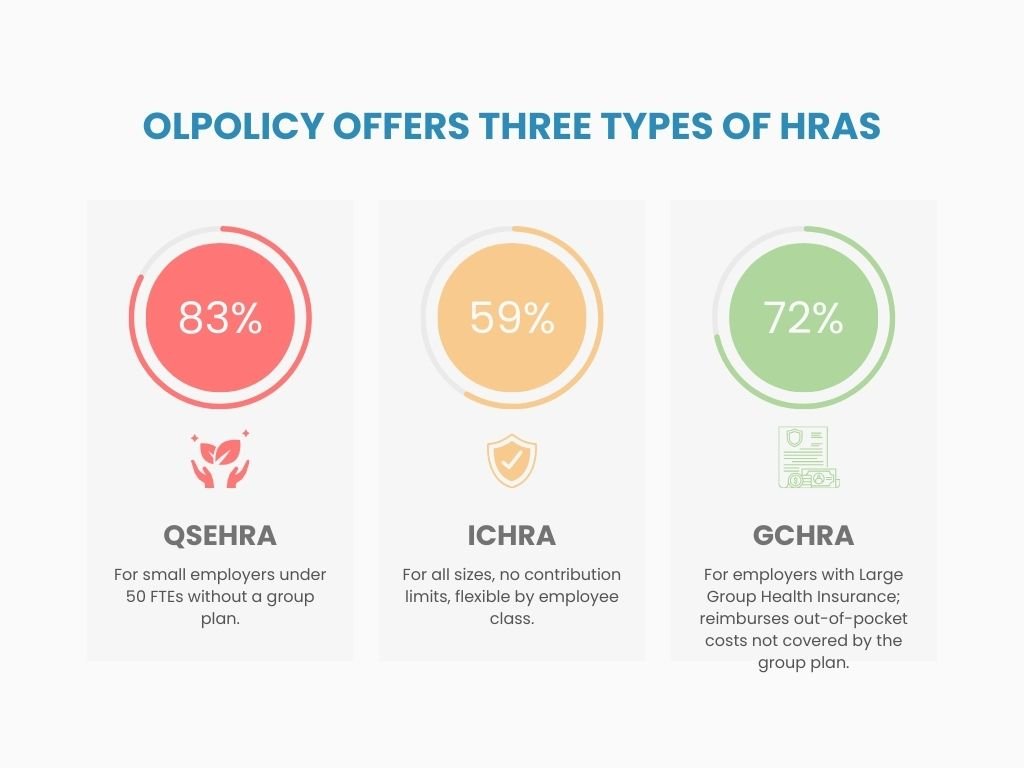

OLPolicy offers three types of HRAs:

No matter your company size, HRAs provide a customizable and cost-effective alternative to Large Group Health Insurance. They give employees flexibility while helping employers control healthcare costs.

Large Group Health Insurance is a very popular employee profit in the U.S. It is offered by many employers to their employees and their families. It is also basic medical, and it complies with the regulations. However, it has limitations. Restrictive participation conditions, high cost and lack of flexibility may render it improper to all companies.

Fortunately, employers have more modern, flexible coverage in relation to health coverage. The alternatives to the traditional group plans include personalized benefits in the form of Health Reimbursement Arrangements (HRAs). HRAs enable employers to manage their spending budget and also ensure that employees have increased options on how they utilize their health benefits.

The HRAs are very customizable unlike the Large Group Health Insurance. Employers are able to alter this contribution parameters, establish eligible expenses as well as designing plans that address the demands of various employee groups. Employees have a greater control over their medical decisions and they can spend money on expenses not available in regular plans.

In the case of large companies, HRA may supplement Large Group Health Insurance to meet out-of-pocket costs or provide flexibility to the already existing plans. HRAs are a primary benefit that allows small employers to pay their benefits without the administrative workload of a full group plan.

Finally, the most suitable one will rely on the size, budget, and workforce requirements of a company. Although the Large Group Health Insurance is still a good option to many businesses, HRAs and other customized systems offer cost-efficient and flexible options. These new-fangled alternatives assist employers in bringing and retaining talents as well as providing the employees with added control over their health cover.