Pompano Beach offers oceanfront living, renovated apartment communities and older Florida rental homes across neighborhoods such as Palm Aire, Cypress Bend, Cresthaven, Norwood and Harbor Village. With ocean winds, seasonal storms, rising humidity and aging building systems, renters experience sudden damage more frequently than expected. For this reason, understanding Renters Insurance in Pompano Beach FL is essential for anyone renting in the 33060, 33062, 33064 or 33069 areas.

Many renters mistakenly believe their landlord’s insurance protects personal belongings. In reality, the landlord’s policy only covers the building-not your furniture, electronics, clothing, valuables or liability expenses. A renters insurance policy provides the coverage needed to protect your daily life and financial security.

This guide is informed by common issues reported by renters across Broward County and insights from professionals who work with Florida insurance carriers.

Pompano Beach renters face coastal-specific risks that directly impact their living conditions and insurance needs. Renters searching for terms like best renters insurance Pompano Beach FL, renters insurance near me or renters insurance quote Pompano Beach are often dealing with issues caused by weather, building age and community infrastructure.

Renters insurance helps protect against these unpredictable and costly events.

Before comparing renters insurance companies or requesting a quote, renters should understand what their policy covers.

Covers items damaged by fire, smoke, theft, storms, burst pipes or certain water issues. This includes electronics, furniture, décor, appliances and clothing.

Coastal storms and humidity make this coverage essential.

Protects renters if someone is injured inside their home or if their actions cause accidental property damage to another unit. Liability coverage is required by many Pompano Beach landlords.

If your rental home becomes unlivable due to water damage, electrical failure or fire, your policy covers hotel stays, meals and transportation. Temporary housing can be expensive in areas like Cresthaven and Palm Aire, making this coverage especially valuable.

Renters often add:

Optional coverage should match your building type and lifestyle.

Standard renters insurance does not cover flooding caused by rising water or storm surge. This affects renters living near the Intracoastal, in low-lying areas or near canal systems.

Flood insurance is offered separately through FEMA’s National Flood Insurance Program (NFIP) and select private carriers. Renters should consider this additional protection if their building is located near waterways or in flood-prone zones.

Building leaks are common in older rentals, especially in 33060 and 33069.

Lightning-based surges can destroy expensive electronics.

Parking lots and shared storage spaces experience occasional theft.

Temporary housing can exceed $150–$200 per night without insurance.

Renters who compare affordable renters insurance in Pompano Beach often find that small monthly payments prevent major financial stress.

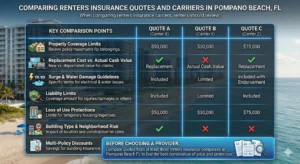

When comparing renters insurance carriers, renters should review:

Before choosing a provider, renters should compare quotes from at least three renters insurance companies in Pompano Beach FL to find the best combination of price and protection.

| Insurance Company | Strengths | Best For | Est. Monthly Cost | Notes |

| State Farm | Personalized service, strong financial rating | Renters wanting replacement cost | $18–$30 | Good for long-term stability |

| Allstate | Many discounts, flexible plans | Renters wanting customizable protection | $20–$32 | Good multi-policy savings |

| Progressive | Competitive pricing, bundling | Renters with auto policies | $17–$28 | Easy online process |

| GEICO | Affordable, simple quotes | Renters wanting low-cost insurance | $16–$25 | Uses partner carriers |

| Travelers | High-value coverage options | Renters with expensive electronics | $22–$35 | Strong liability options |

| OLPolicy.com | Compares all top carriers | Renters wanting the lowest rate quickly | Varies | Marketplace with tailored quotes |

Coastal storms frequently cause window leaks, roof issues and AC malfunctions.

Older buildings often experience pipe bursts or water heater failures.

South Florida’s lightning often causes expensive electronics damage.

Even secure communities report vehicle or patio storage theft.

Renters may need hotel stays or short-term rentals when repairs are needed.

Most renters pay between $17 and $32 per month, depending on:

Renters seeking cheap renters insurance in Pompano Beach FL should compare multiple carriers to find the most affordable and reliable option.

| Expense Type | Without Insurance | With Renters Insurance |

| Laptop replacement | $800–$1,500 | Covered |

| TV/gaming system | $300–$1,000 | Covered |

| Furniture after water damage | $300–$1,200 | Covered |

| Clothes ruined by smoke/leak | $200–$600 | Covered |

| Temporary housing | $120–$200 per night | Covered |

| Food & transportation | $30–$50 per day | Covered |

Not by law, but many landlords require renters insurance.

It covers wind-driven rain and lightning damage but does not cover flooding.

State Farm, GEICO, Allstate, Progressive and Travelers are popular options. OLPolicy helps renters compare them instantly.

Typically $17–$32 per month.

Visit OLPolicy.com and compare quotes from multiple carriers.

Finding the right renters insurance should be simple and affordable. At OLPolicy, renters can compare top-rated carriers, review coverage options and choose insurance that fits their budget and building type.

Whether you rent a beachfront condo, renovated apartment or older home, OLPolicy helps you understand:

To get the most accurate renters insurance quote in Pompano Beach FL, visit OLPolicy and request your personalized quote today.

Insurance pricing varies based on underwriting, building type and individual risk factors. All cost examples are estimates and may differ by carrier.