Kissimmee, Florida is one of the fastest-growing rental markets in Central Florida. With its close proximity to Orlando, major theme parks, hotels and employment hubs, thousands of families, professionals, students and seasonal renters choose to live here every year. Whether you rent an apartment near West Irlo Bronson Memorial Highway, a condo close to Disney area resorts, or a home in Poinciana, one thing remains the same unexpected losses can happen anytime.

That’s why Renters Insurance in Kissimmee, FL is no longer optional for smart renters. It provides affordable financial protection against theft, fire, water damage and personal liability, all while costing far less than most people expect.

This guide explains exactly why Kissimmee renters need insurance, how much it costs, what it covers and how to choose the right policy without overpaying.

Many renters assume their landlord’s insurance will cover their personal belongings, but that’s a costly misunderstanding. A landlord’s policy only protects the building, not what’s inside your unit.

Kissimmee renters face specific risks such as:

⇒Hurricanes and severe storms

⇒Water damage from plumbing or upstairs units

⇒Fire incidents in apartment complexes

⇒Theft or burglary, especially in high-traffic tourist areas

⇒Liability claims if someone is injured inside your rental

Without renters insurance, replacing furniture, electronics, clothes or paying legal expenses comes entirely out of pocket. That’s exactly why renters insurance is becoming essential across Kissimmee, Florida.

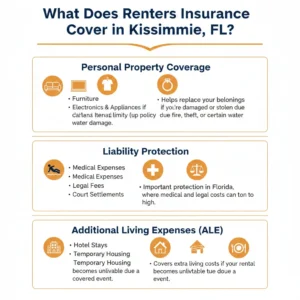

A standard renters insurance policy in Kissimmee typically includes three main types of protection:

This covers your belongings such as:

⇒Furniture

⇒Electronics and appliances

⇒Clothing and personal items

⇒Jewelry (up to policy limits)

If your items are damaged or stolen due to covered events like fire, theft, or certain water damage, your policy helps pay for replacement.

If someone slips, falls, or gets injured inside your rental, liability coverage helps cover:

⇒Medical expenses

⇒Legal fees

⇒Court settlements

This is especially important in Florida, where medical and legal costs can be high.

If your rental becomes unlivable due to a covered event, renters insurance can help pay for:

⇒Hotel stays

⇒Temporary housing

⇒Meals and daily living costs

One of the biggest advantages of renters insurance is affordability. On average:

| Coverage Level | Estimated Monthly Cost |

| Basic Coverage | $10 – $15 |

| Standard Coverage | $15 – $20 |

| Higher Coverage Limits | $20 – $30 |

Most renters in Kissimmee pay less than $1 per day for reliable protection. Compared to replacing thousands of dollars’ worth of belongings, renters insurance is a smart financial decision.

Many apartment complexes and property managers in Kissimmee now require renters insurance as part of the lease agreement. Even when it’s not mandatory, landlords strongly recommend it to reduce liability risks.

Having a policy can also:

This is a common question among Florida renters.

If you live in a flood-prone area of Kissimmee, consider adding a separate flood insurance policy for full protection.

When comparing policies, local renters should focus on:

Choosing the right policy ensures you’re protected without paying for coverage you don’t need.

Renters insurance is ideal for:

If you rent any type of property in Kissimmee, renters insurance is worth it.

Absolutely. With rising living costs, unpredictable weather and increasing rental requirements, Renters Insurance in Kissimmee, FL offers peace of mind at a very low cost. It protects your belongings, finances and future when you need it most.

If you’re unsure how much coverage you need or want a quick comparison, getting a quote is the smartest next step.

Call (866) 757-5350 or visit olpolicy.com to get a free renters insurance quote today.