If you are renting a home or apartment in Hollywood, FL, the right renters insurance can give you real peace of mind. Coastal weather, storms, and daily accidents can damage your personal property, cause water damage, or even make your place uninhabitable. Renters Insurance in Hollywood FL helps tenants safeguard their belongings and stay protected against water damage, theft, and covered losses.

Many tenants think homeowner or landlord’s insurance is enough, but those policies protect the building, not your stuff. Only renters insurance policies and related products like apartment insurance or renters policy are designed to provide coverage for your personal possessions inside a rented property.

A standard policy is a simple insurance program with three main parts: coverage for your personal property, personal liability, and additional living expenses.

Personal property coverage protects your personal belongings and personal items such as:

If fire, theft, smoke, or sudden water damage causes property damage, your policy helps pay what it would cost to replace items, depending on your coverage limits and whether you choose replacement cost or a policy that factors in depreciation.

This is why many insurance agents and any experienced insurance agency will recommend replacement cost and help you pick appropriate coverage limits based on a quick home inventory.

Personal liability and liability coverage protect you when you are legally responsible for damage or injuries:

Liability protection helps insure you against lawsuits and medical bills. It lets renters insurance ensures you don’t pay everything out of pocket due to a covered loss.

If a fire or other covered loss makes your home becomes uninhabitable or simply uninhabitable, additional living expenses coverage pays for temporary living expenses, such as:

This part of your coverage is vital for tenants who do not have savings to handle a sudden move.

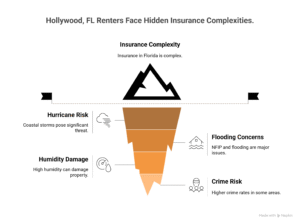

Hollywood renters face several unique risks:

Because of these conditions, insurance in Florida is slightly more complex. Insurance may have stricter limitations and exclusions or special deductibles. However, there are still many companies offering affordable renters insurance with competitive rates and reliable coverage tailored to your specific needs.

Some well-known providers, such as State Farm®, other major insurer brands, local insurance agency offices, and independent insurance agents, help Hollywood tenants find affordable plans. You can often bundle renters and auto or renters with auto insurance or auto policies for discounts.

When you talk to an agent or get a renters insurance quote, ask about:

Good insurance coverage should protect your personal belongings and meet your insurance needs without overpaying. A professional can underwrite your renters coverage based on your situation, income, and property value.

Standard renters insurance in Florida does not cover flooding. To protect against flood property damage, you may need a separate policy through the National Flood Insurance Program or private insurers that work with nfip.

However, renters insurance still helps when you have water damage from sudden pipe bursts or appliance leaks. This is a major reason many people in Hollywood, FL look at questions about renters insurance before deciding on the best insurance for them.

Prices vary, but many tenants find affordable policies by getting a:

By comparing offers, you can get competitive rates and appropriate coverage limits. Many tenants use online tools to quote today, then speak with a OLPolicy agent or local insurance agency to finalize the whole insurance process.

Good renters insurance is designed to protect your belongings, protect your personal property, and shield you from financial risk. It helps when:

Whether you choose a stand-alone renters policy or a bundle with renters and auto, the goal is the same: protect your belongings and maintain control over your finances.

It’s important to know the difference between:

Only renters insurance and related products provide coverage for your own items in a rented property.

If you still have questions about renters insurance, reach out to:

They can help you:

The goal is to make sure renters insurance ensures real protection, not just a piece of paper.

With clear coverage options, solid insurance coverage, and help from knowledgeable insurance agents, renters in Hollywood, FL can protect their belongings, maintain control after a covered loss, and enjoy their life near the beach with true financial security.