Coral Springs is a well-planned and peaceful city, known for its quiet neighborhoods, parks, and well-maintained apartment communities. Many people move here because it offers a safe, family-friendly environment while still being close to major South Florida cities.

But even in a place that feels secure, renters often discover that unexpected problems can appear without warning. A leaking ceiling, a sudden power surge, or a break-in can quickly turn a normal day into a stressful situation.

This is where Renters Insurance in Coral Springs FL becomes important—not as something complicated or expensive, but as a simple tool that protects you when life surprises you in the worst way.

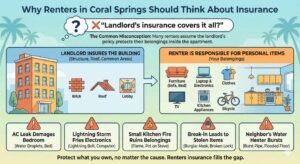

Most renters here assume the same thing at first:

If something happens inside my apartment, the landlord’s insurance will take care of it.

But the truth is, landlords only insure the building, not the items you own.

That means your furniture, laptop, clothes, TV, kitchen appliances, or even your bicycle are your responsibility—no matter what caused the damage.

Coral Springs renters often learn this the hard way after:

Instead of paying hundreds or thousands of dollars to replace everything, renters insurance handles those costs for you.

Coral Springs has a higher living cost compared to many Florida cities, and unexpected expenses can create financial pressure for renters. The table below shows how fast costs add up when renters don’t have insurance, compared to what renters insurance typically covers.

| Expense Type | Real Cost Without Insurance | How Renters Insurance Helps |

| Replacing a Laptop | $800–$1,500 | Covered under personal property protection |

| Replacing a TV | $300–$700 | Covered if damaged by fire, water, or surge |

| Furniture Damage (bed, couch, dresser) | $400–$1,200+ | Covered if damaged by leaks, fire, or smoke |

| Clothes After Water or Mold Damage | $300–$600 | Covered under personal belongings |

| Power Surge Damage to Electronics | $150–$2,000 depending on items | Covered with optional surge or electronics protection |

| Hotel Stay After Major Damage | $120–$200 per night | Paid under Loss of Use coverage |

| Extra Food & Living Expenses | $30–$50 per day | Also covered under Loss of Use |

| Cleaning & Laundry After Fire/Smoke | $50–$300 | Often reimbursed depending on policy |

| Storage for Belongings During Repairs | $75–$150 monthly | Covered when displacement is caused by a covered event |

| Monthly Cost | What You Get |

| $15–$30 per month | Protection for thousands of dollars’ worth of belongings, liability coverage, and temporary housing if your apartment becomes unlivable |

Coral Springs is a wonderful place to live, but no city is free from accidents, storms, or unexpected problems. Renters insurance is an affordable way to protect your belongings, your budget and your peace of mind.

For renters who want stability and financial safety, having a policy is not just smart – it’s a practical decision that fits the real cost of living in Coral Springs.