Starting a business is exciting but also risky. BOP business insurance helps protect your small business from loss. It includes such things as fire, theft or accidents. This insurance will give you a free hand to ensure you grow your business.

A Business Owner’s Policy (BOP) is a common type of insurance that helps protect your business. Many small business owners choose it because it combines several coverages into one plan. This makes it faster to get and often cheaper than buying each coverage on its own.

One big benefit of a BOP Business Insurance is that it can save money. So, many business owners ask, “How much does a BOP cost?”

The price of a BOP depends on different things. In this guide, we will look at the main factors that affect the cost. This will help business owners get an idea of what they might pay for this insurance.

A BOP Business Insurance usually has three types: general liability, property, and business interruption.

General liability insurance helps your business pay if someone gets hurt or their things are broken because of your business. It also helps if there is a problem with advertising, like copyright or false claims.

“Pay” means legal costs, settlement money, or bills for injury or damage. For example, if a customer slips and falls in your store, general liability can help.

Property insurance pays for damage to your building and stuff inside. This includes equipment, furniture, and inventory. For example, if a fire damages your restaurant, property insurance can help fix or replace your property.

Business interruption insurance helps if your business must close for a while. It can pay for lost money, bills, loans, and employee wages until your business opens again.

The basic BOP has general liability, property, and business interruption insurance. But businesses can make their BOP stronger by adding extra coverages.

These extra coverages are called endorsements. Each endorsement makes your BOP cost a little more.

Some common endorsements are:

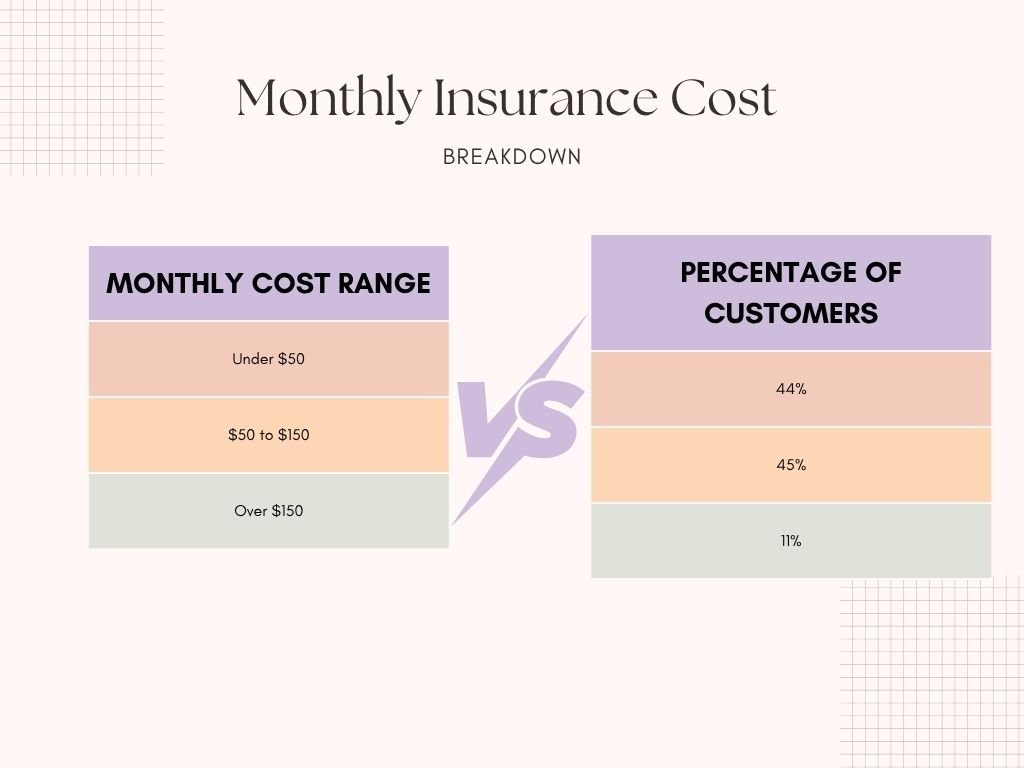

Here is what small business owners usually pay for BOP insurance:

Monthly Costs:

The cost depends on things like your type of business, location, number of employees, and how much coverage you want. Most small businesses pay less than $150 each month.

These numbers come from real policies. But getting a good price is not just about numbers. It is also worth having an insurance partner that understands your business. One of the benefits of going through the right company is that you find the best policy that suits your needs and budget.

The type of business you run affects your BOP insurance cost. Some businesses have more risk, so they pay more. Others have less risk, so they pay less.

Here are the usual monthly costs for some common businesses:

Monthly BOP Business Insurance Cost for Top Trades:

Where your business is matters. Some things that can change your BOP cost are:

Even the same type of business can cost more or less depending on the state.

Monthly BOP Cost by State:

Insurer: Different insurance companies charge different prices for BOP Business Insurance. Some are cheaper, some are more expensive. Choosing the right insurer can help you get good coverage at a lower cost.

Industry: The type of business you run matters. High-risk businesses, like construction, usually pay more. Low-risk businesses, like software companies, usually pay less.

Size and Location: More employees usually mean higher costs. Urban businesses often pay more than rural businesses. If your area has natural disasters like floods, fires, or hurricanes, your BOP will cost more.

Property Value: The value of your building, equipment, inventory, and other property affects your insurance cost. Expensive property means higher premiums. Higher liability limits also increase the cost.

Claims History: If your business has many past claims, insurers see you as a higher risk, so your BOP Business Insurance cost will be higher. If you rarely have claims, your cost will be lower.

When you get property coverage, you can pick replacement cost or actual cash value.

The deductible is the money you pay when something happens. A higher deductible means your insurance cost is lower. The insurer charges less because you pay more of the loss.

This works well if your business is low-risk and has few claims. If your business is higher risk, a high deductible can make you pay more when a claim happens, even if your monthly premium is lower.

BOP business insurance helps protect small businesses from fire, theft, accidents, and other losses. It combines general liability, property, and business interruption coverage in one plan.

You can add extra coverages, called endorsements, for more protection. The cost of a BOP Business Insurance depends on your business type, location, size, property value, claims history, and insurer.

Replacement cost policies pay full value, while actual cash value policies pay less. A higher deductible can lower your monthly cost, but may increase your cost during a claim.

Overall, a BOP gives startups and small businesses peace of mind and saves money.