Anthem Health Insurance Company is among the largest health insurance firms in the US. It is the third-largest company in the country, and it provides plans in 50 states. The company strives to satisfy the demands of a large number of groups. This involves the individuals, families, aged people and those who are eligible to state Medicaid programs.

Anthem Health Insurance Company is not working in isolation. It operates across smaller affiliate businesses and collaborators that operate within some states and regions. Anthem has over 106 million customers hence its network of individuals who have trust in its plans and services has been very large.

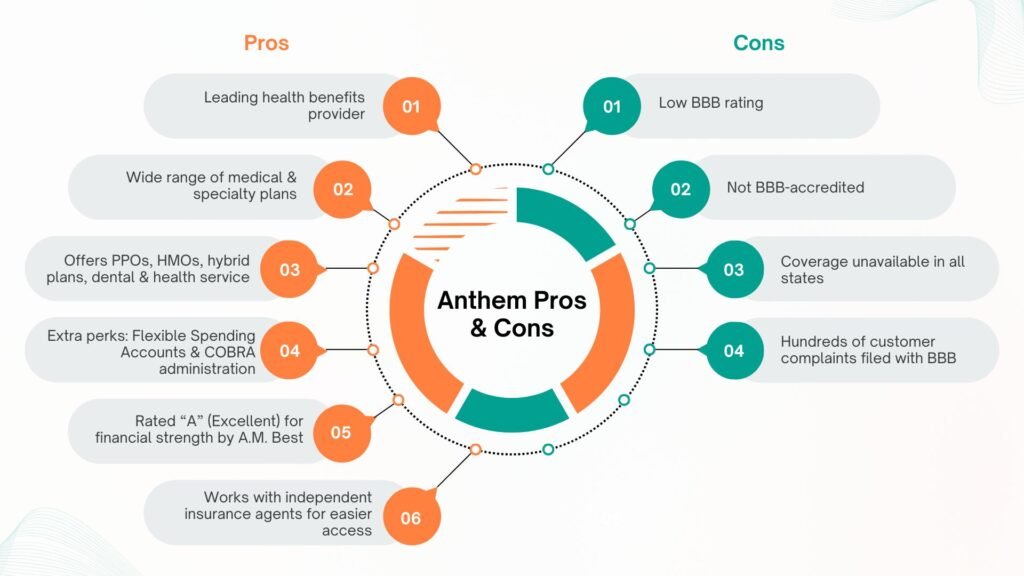

Extensive variety of health plans is one of the principal advantages of Anthem Health Insurance Company. These are plans that are tailored to suit various requirements and income. The Anthem network has numerous doctors and hospitals that can be accessed by the customers, which makes care more flexible.

Nevertheless, some cons are to be known. The costs and coverage of the plans can be different in the states. The reviews by customers are not either positive or negative as some are satisfied and some are less satisfied. Comparing the benefits, costs, and rating of Anthem before making a decision would be the best way to determine whether it is the correct choice or not.

Anthem Health Insurance Company is the U.S. largest health insurance company. It has a population of more than 107 million, and more than 43million members in its family of health plans. Anthem consists of numerous companies, one of the most popular being the Anthem Blue Cross Blue Shield.

The Anthem Health Insurance Company has acquired mixed ratings. AM Best has a high rating on its financial strength. Nonetheless, Anthem and some of its partners have a low rating by the Better Business Bureau (BBB). This happens primarily due to previous cyberattacks, refusal of claims, and customer service issues.

There are a lot of health plans provided by Anthem Health Insurance Company. These consist of PPOs, HMOs, hybrid plans, dental plans among other medical services. Individuals have the option of opting to have simple cover or more comprehensive plans depending on their requirements. Other benefits which Anthem offers include flexible spending accounts and COBRA administration.

The company markets plans both with direct agents and independent insurance agents. This facilitates easier comparison and purchase of coverage by people. Nevertheless, the level of customer complaints is very high at Anthem. That is why it is prudent to consider other alternatives to be able to make a decision whether Anthem is the best option among them.

Finding the right health insurance is not always easy. Plans, costs, and services can change based on where you live. Anthem Health Insurance Company makes it easier for people to search for plans in their own state. The company has a large network and works with many agents across the country.

If you want to explore options, you can use a national insurance directory. This tool helps you see which companies, including Anthem Health Insurance Company, offer coverage near you. You can also find out which plans match your needs. For example, some people may want a basic plan with low costs, while others may prefer a full plan with more benefits.

Anthem Health Insurance Company works with local agents, so it is easy to get personal help. An agent can explain coverage, answer questions, and guide you to the best plan. This saves time and makes the process less confusing.

No matter what type of coverage you need, using the directory and connecting with an agent is a smart first step. Anthem Health Insurance Company’s wide range of options ensures that you can find a plan that fits your budget, family, and health care needs.

Anthem Health Insurance Company offers many types of health plans for both individuals and employer groups. The company makes it simple to choose coverage that fits your health, family, and work needs.

Individual and Family Plans Anthem Health Insurance Company provides a wide range of products for single people and families. These include:

These plans help people manage everyday care and protect against high medical costs.

Employer Group Plans: Anthem Health Insurance Company also supports businesses with group coverage. Employers can offer workers the following:

These plans give employees access to care while also helping companies build strong benefits packages.

With so many choices, Anthem Health Insurance Company makes it easy to find plans for individuals, families, or workplaces. This wide range of products helps customers select coverage that matches their lifestyle and budget.

The price of health insurance is not the same for everyone. Anthem Health Insurance Company’s prices can change based on many personal factors. For example, your health, job type, and the state you live in can all impact how much you pay. Because of this, two people may pay very different amounts, even if they choose the same type of plan.

Anthem Health Insurance Company offers a wide range of plan options. Some plans have lower monthly costs but may include higher deductibles. Other plans may cost more each month but provide more complete coverage for medical care. The right plan depends on your needs and budget.

Since prices can be complex, it is a good idea to work with an independent insurance agent. An agent can look at Anthem Health Insurance Company plans in your area, compare prices, and help you find the best match. They can also provide free quotes so you can see the real cost before you decide.

Overall, Anthem Health Insurance Company offers plans for different income levels and lifestyles. By checking quotes and exploring your options, you can find a plan that balances cost and coverage for your family’s health care.

Anthem Health Insurance Company does not share many details about its discount programs. Unlike some insurers that list savings or reward options, Anthem’s discount information is not easy to find. However, you may still qualify for cost-saving opportunities. The best way to learn about them is by working with an independent insurance agent. Agents can explain any available Anthem Health Insurance Company discounts and show you other ways to lower your costs.

Customer service is also a key part of Anthem Health Insurance Company. Members have several ways to reach the company for help:

Service hours may vary by state. In most areas, phone support is open Monday through Friday, from 8:00 a.m. to 5:00 p.m. Customer service is closed on Saturdays and Sundays.

For the best experience, many people use an independent insurance agent. These agents can help with questions, claims, and issues, making Anthem Health Insurance Company coverage easier to manage. With the right support, you can relax knowing help is always available when you need it.