ACE Medicare Supplement is part of ACE Property & Casualty Insurance Company. It is also linked with Chubb Corporation. This plan gives extra help with Medicare. Seniors can use it to pay less for health care. It helps cover costs like deductibles, copayments, and coinsurance.

In this blog, we talk about ACE Medicare Supplement plans. You will learn their main features, where they are offered, and how they compare with other Medigap plans.

Medicare supplement plan or Medigap is additional insurance that you may purchase through any private entity. It assists in the payment of expenses not including Original Medicare (Part A and B).

ACE Medicare Supplement is among those that cover such additional expenses of seniors. All the plans possess various advantages, and it is necessary to choose the one that suits your requirements and your condition.

A lot of stuff will alter the functioning of a plan. The type of plan that best suits you can depend on your health, your residence and many others. Even a plan that appears good might not be comprehensive of what you need.

Due to the confusing nature of Medicare, a good idea is to discuss it with a licensed agent or refer to the Medicare plan finder tool. This assists you to identify the appropriate ACE Medicare Supplement plan that suits you.

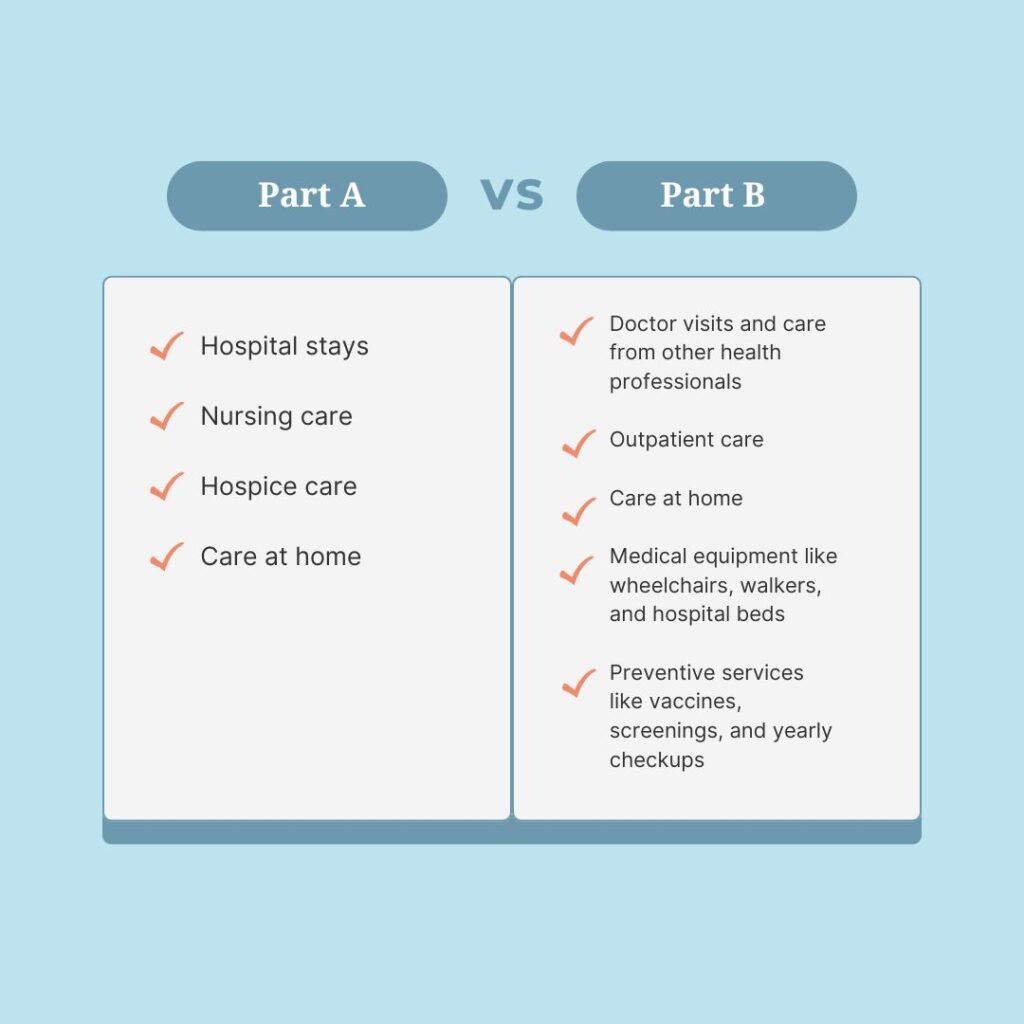

We shall then examine the coverage of Part A and B of Medicare and the assistance that is offered by ACE Medicare Supplement to cover the additional expenses.

Medicare Part A helps pay for:

Medicare Part B helps pay for:

Medicare Part B usually pays about 80% of medical costs. The other 20% is out of pocket. ACE Medicare Supplement can help pay the remaining 20%, giving you extra protection.

Coverage Category

What ACE Medicare Supplement Pays

Hospital Costs

Pays Part A coinsurance and hospital bills for up to 365 extra days after Medicare runs out.

Outpatient Care

Helps pay Part B coinsurance or copay for doctor visits, checkups, and outpatient care.

Skilled Nursing

Pays coinsurance for longer skilled nursing care under Medicare Part A.

Part A Deductible

ACE Medicare Supplement Plan Types

Plan

What ACE Medicare Supplement Pays

Who It’s For

Plan F

Covers almost all costs, including Part B deductible

Only for people who joined Medicare before Jan 1, 2020

Plan G

Almost same as Plan F but does not cover Part B deductible

Good for people who want strong coverage

Plan N

Lower monthly cost, but you pay small copays for doctor or ER visits

Good for people who want lower premiums

Plans may differ by state. Check with ACE Medicare Supplement or a licensed agent for the plans available where you live.

ACE Medicare Supplement has special features that make it valuable for seniors:

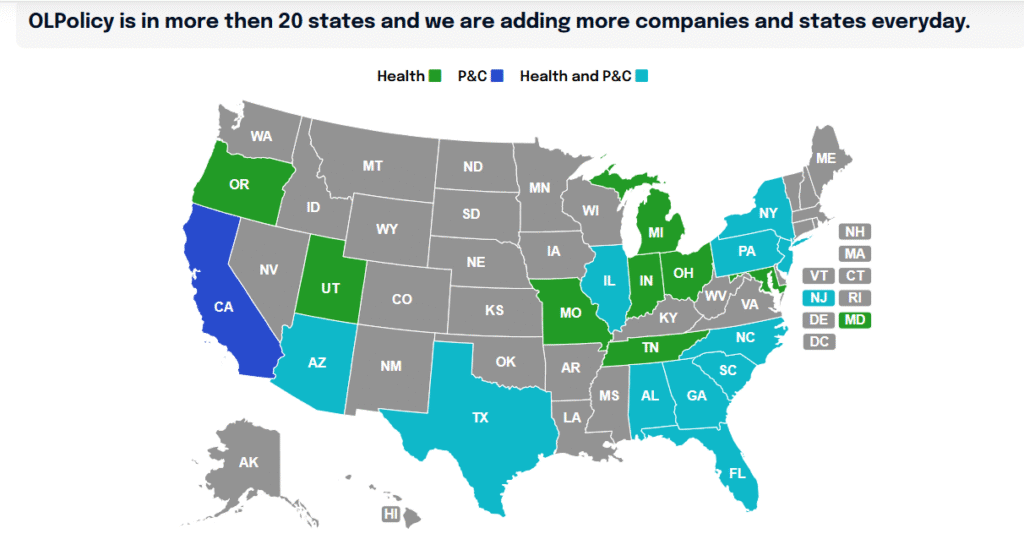

ACE Medicare Supplement plans are offered in many states, but prices and coverage can change depending on where you live.

Some states with ACE Medicare Supplement plans are: Arkansas, Arizona, Georgia, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Michigan, Mississippi, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, West Virginia, and Wisconsin.

Prices may be higher in states with higher healthcare costs. ACE Supplement uses three ways to set premiums:

Check with ACE or a licensed agent to see the best plan and price for you.

ACE Supplement, offered by ACE Property & Casualty Insurance Company and Chubb, has very high ratings from top agencies. These ratings show the company is strong and reliable.

These ratings give confidence that ACE Supplement can pay claims and provide secure coverage for seniors.

ACE Supplement competes with top companies like Aetna and Humana. It has some benefits that make it stand out:

Underwriting Rules ACE Supplement has simple rules like other Medigap carriers. If you apply outside the Open Enrollment Period, you may need a health check. ACE looks at health conditions to decide if you can join and what your premium will be. They keep rules fair so more people can get coverage.

When signing up for ACE Medicare Supplement, it is important to know these dates: