WellPoint Insurance Reviews help people who want health insurance. It keeps your health safe from big problems. You can buy it online very fast. You do not need to fill out many papers. Many people like it because it is simple to use.

In 2025, many patients trust WellPoint Insurance. It gives help when things go wrong. The plans are easy and the price is fair. You can use your phone or computer to manage it. It also has people to help you anytime.

WellPoint Insurance Reviews make your health care safe and simple.

WellPoint Insurance Reviews are used to protect the health of the people. It includes medical visits of the doctor, hospital, and so on. You can make a registration in a short time. No need for lots of paperwork.

The strategies are comprehensible. Prices are fair. You are able to control your plan either in your phone or a computer. There is a helping hand when you require it.

Some users have had problems. They state that the doctors accepting WellPoint are difficult to find. Others had difficulties with care. Others had billing issues.

Nevertheless, WellPoint Insurance Reviews is a selection of many despite these issues. Some individuals have faith in it as their health care in 2025.

WellPoint Insurance Reviews help people get health care. It covers doctor visits, hospital stays, and some medical treatments.

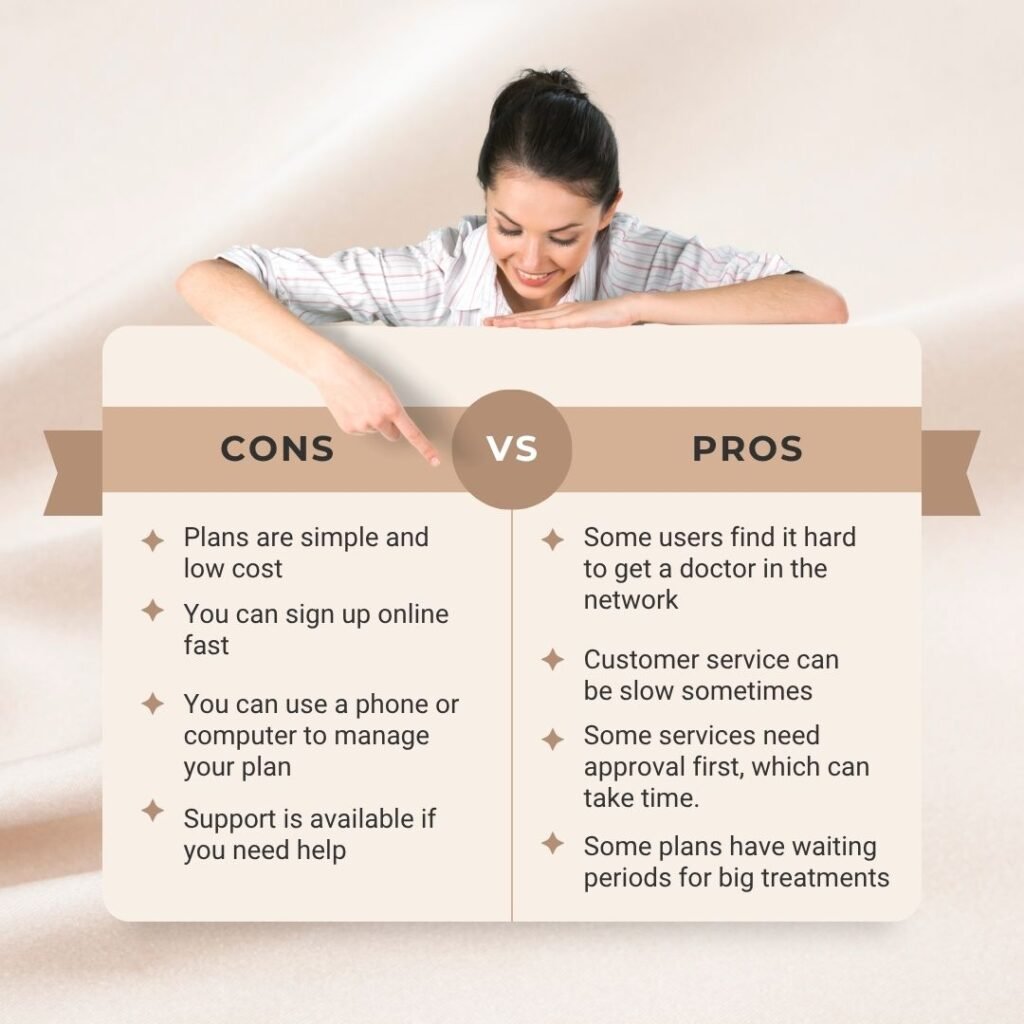

Pros

Cons

WellPoint Insurance Reviews is good for simple, online health coverage. But if you need fast access to doctors or in-person help, it may not be the best choice.

The WellPoint Insurance Reviews assist individuals in obtaining health care. It keeps you in good shape and covers you against expensive medical bills.

You can sign up online fast. You do not need a lot of papers. It is easy to use and this is why many people like it.

The plans include doctor visits, hospitalization as well as some treatments in medicine. You are capable of controlling your plan either on a computer or a phone. You have a hand when you require it.

According to some users, the network may require a long time to locate a doctor. The service to customers is sometimes slow. There are treatments that require approval prior to care, thus postponing care.

WellPoint Insurance Reviews is a company that is believed by numerous individuals despite these problems. Most people opt to use it in 2025 because it will provide them with a convenient and affordable health cover.

Health Insurance Types: WellPoint Insurance gives simple plans. It helps people stay healthy and reduce medical costs. You can choose what fits your needs.

WellPoint Insurance Reviews gives all these plans in one place. You can pick what you need and stay safe from high medical costs.

WellPoint Insurance Reviews provides numerous options to individuals willing to be covered by health insurance. The price varies based on your age and location and the kind of care that you require. It is also based on the plan you will select.

The average monthly payment of most individuals is between 30-80 dollars on basic health cover. The entry point of low-cost plans is as low as 25 a month.

WellPoint does not make it hard to see your price online. A quote can be taken within a few minutes. Take a couple of quick home assessments on what you need in terms of your health, and you will see what your plan will be and the price. It is fast and easy – ideal when one is in a hurry and prefers to be covered easily.

Type of Plan

Points

WellPoint Insurance Reviews gives choices to fit different needs. You can pick the plan that works best for you and keep your health care affordable.

WellPoint Insurance Reviews have mixed feedback from users. Some customers are happy with the service, while others report issues with finding doctors or getting care.

Here are some customer ratings for WellPoint Insurance from popular sites:

| Review Site | Star Rating (out of 5) | Number of Reviews |

| Trustpilot | 2.0 | 80 |

| BBB | Not listed | Not listed |

| BestCompany | Not listed | Not listed |

In this WellPoint Insurance Review, it is clear that some users are unhappy. They mention difficulty finding a doctor who accepts WellPoint, slow customer support, and problems with billing. However, many customers like the easy online sign-up and the convenience of managing their plan through the WellPoint app.

Overall, WellPoint Insurance Reviews work well for those who want simple and quick health coverage. But if you need a wide network of doctors or in-person support, it may not be the best fit.

WellPoint Insurance Reviews help people get health care. It keeps you healthy and lowers medical costs.

WellPoint makes signing up easy. You can get a plan online fast. You do not need many papers. You can manage your plan on a phone or computer.

The plans cover doctor visits, hospital care, minor treatments, and major medical procedures. Some plans also cover specialists. You can talk to a doctor online with telehealth visits.

Some people like WellPoint Insurance for fast online setup and easy digital tools. Some find it hard to find a doctor in the network. A few have slow customer service or billing issues.

Costs depend on age, location, and plan type. Most people pay $30–$80 per month. Low-cost plans start around $25 per month.

WellPoint Insurance Reviews give simple and easy options. Reading WellPoint Insurance Reviews helps you pick the best plan for your health care.