You own a dog, cat or any other pet and you ask yourself, is pet insurance worth it? This is the thought of many owners of pets. In 2018, American people spent more than 1 billion USD on pet insurance.

This was at 23 percent higher than last year. There are millions of insured pets today. There are several plans which offer life-long affordable care, which is not always the case.

Certain accident and illness plans are costly and may not provide coverage to your pet throughout its life.

Yes! It can cover the majority of the vet bills with the proper plan. There are a lot of pets that require emergency treatment annually.

It is very expensive, up to an excess of $1500. Pet insurance may be used to cover such bills even up to over 7,000. This is because you can now be able to take good care of your pet without making the issue of money a concern.

Pet insurance can save you money over time. You pay a little each month instead of a big bill all at once. It also gives you peace of mind. You can get your pet the care they need if they get sick or have an accident.

Is pet insurance worth it? Veterinary care can cost a lot, and it may get even more expensive in the future. Most pet owners don’t like to think about accidents or serious illnesses, so they don’t plan for high vet bills.

But planning ahead helps you care for your pet and lowers stress about money. The 2024 survey by the American Veterinary Medical Association shows the average pet parent spent $1,515 on their pets in 2023 and 2024. A big part of this cost is veterinary care and products.

Many pets may need special care, and costs can be high. For example, spaying or neutering costs $160–$220. Teeth cleaning can be $707. Cancer treatment may reach $4,000. Diabetes care costs $1,600–$2,900. Vision care can be $220–$320. Heart problems may cost $1,140. Bladder or urinary infections can cost $1,053. Kidney disease treatment may reach $1,318. Dental disease costs $768, and hernia surgery can be $700–$2,500. Pet insurance can help cover these expensive treatments.

Emergency visits can be expensive because they include exams and tests. Some average costs are: blood work $80–$200, heartworm test $45–$50, fecal exam $25–$45, X-ray $150–$250, ultrasound $300–$600, allergy testing $195–$300, and geriatric screening $85–$110. On top of that, emergencies can cost more depending on the situation. Many pet owners are surprised by these costs. A study found 45% of dog owners and 38% of cat owners were not ready for these expenses before bringing home their pets. Pet insurance can help cover these bills and make care easier.

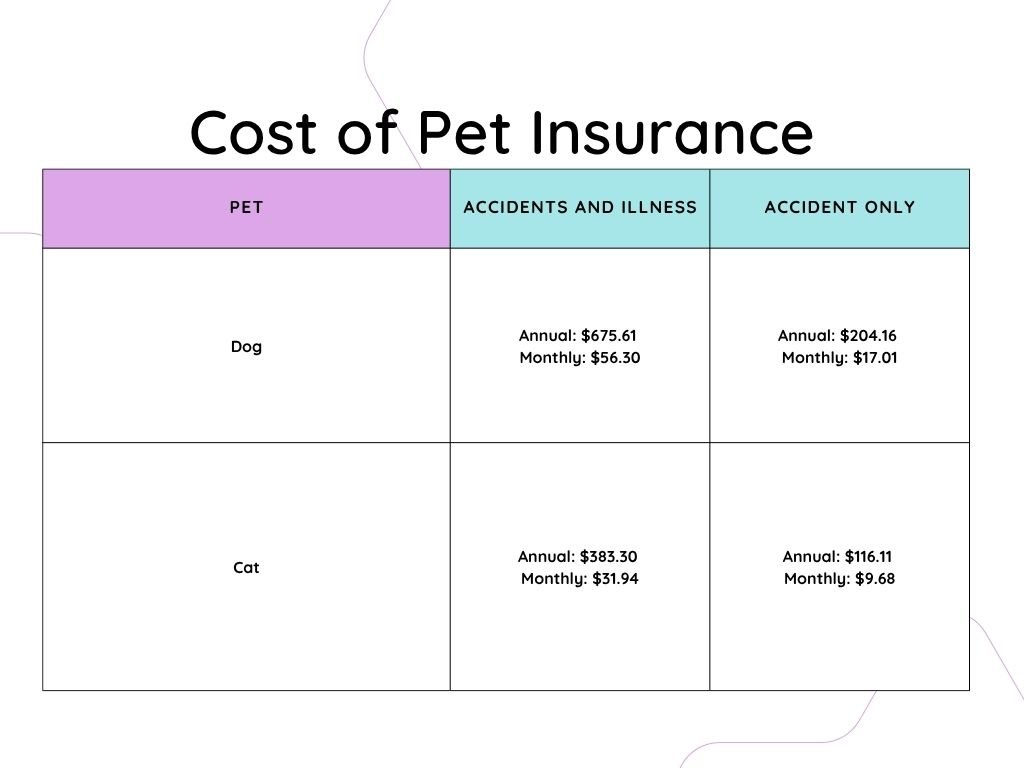

It can help with high vet bills, but the cost depends on your pet’s age, breed, health, where you live, and the plan you choose. In the U.S. for 2023, average annual premiums are about $676 for dogs and $383 for cats for accident and illness coverage. Accident-only plans are cheaper: $204 for dogs and $116 for cats per year. Monthly, this is around $56 for dogs and $32 for cats for full coverage. Pet insurance can make paying for unexpected vet care easier and less stressful.

Pet insurance can help pay 70–100% of vet bills. It covers accidents, sickness, tests, surgery, and medicine. Some plans also cover teeth or inherited problems. Extra benefits can include rehab, lost pet help, or end-of-life care.

Most plans do not cover old sickness, check-ups, or cosmetic care unless you add it. Rules and waiting times are different for each plan. Always read the details before you buy.

Most pet insurance plans pay for many things:

Some pet insurance plans can also cover:

Most pet insurance plans do not pay for:

Is Pet Insurance Worth It for My Pet?

Pet insurance is possible at any point in the life of your pet.

Kittens and puppies: The young pets are easily ill. Their immune system is too weak, and they require vaccinations. They will contract severe illnesses such as parvovirus or panleukopenia. The parasites such as worms are also common.

Adult cats and dogs: Even healthy adult pets may injure or become ill. Dogs can tear a ligament and cats can contract diabetes. At the age of 3, most pets begin experiencing teeth difficulty, as well.

Elderly pets: Elderly pets may develop chronic conditions, such as arthritis. The risk of cancer is also increased.

Tampered pets: Dogs and cats of a particular breeding might develop genetic illnesses at a higher rate.

Exceptional cases: consider the habits of your pet. Outdoor cats can become injured. Application Dogs which put in things they find in the trash might also have stomach issues.

Through pet insurance, one can cover accident, illness and long-term care costs at any given stage.