You brush your teeth well. You smile, floss and brush everyday. One morning you wake up with a sharp toothache, however. When you eat your favorite food or drink water it makes your hurt. You realize you have to visit a dentist.

You reason, however, how much it will cost. It is at this point that the question of whether dental insurance should be considered good arises.

Dental care can be expensive. A small restoration or cleaning may not be much but a major one such as a crown or root canal may be very expensive. Dental insurance will assist in making such visits cheaper. There are some plans that include cleanings and checkups and plans that include bigger treatments.

Whenever you are in doubt of whether you really need dental insurance or not, the answer is yes. You can live without it, but it is dangerous. When a problem with teeth becomes more severe, the eventual cost of its repair will be far higher.

That is why some individuals claim that dental insurance is worth it. It makes you worry free and saves you money in the long term. You do not have to have the biggest plan that only matches your needs and budget.

Whatever, do not disregard pain or gum problems. Proper teeth imply proper life. And with insurance you can get your dental services simpler and less timely when you need them most.

Dental insurance assists you to cover your dental treatment. It operates in a similar manner as health insurance. You make a small payment each month which is referred to as a premium. The plan in its turn does assist in paying a portion of your dentist expenses. You can have your plan partially covered by your boss in case you get your plan through your job.

The dental insurance plans have several rules. You may be required to contribute a little amount of money to assist the plan before it begins, referred to as a deductible. Co-pays or an amount of money that the plan will pay annually may also exist.

Preventative care such as dental cleaning and exams is usually paid in full or nearly. This is to say that you can pay a little or nothing at all. In the case of larger work such as fillings or crowns, you may be required to pay part of the bill. Other schemes also offer reduced rates by visiting a dentist in their scheme.

In many different plans, there is what is referred to as the 100/80/50 rule. This implies that the plan will cover 100 percent of checkups, 80 percent of small treatment and 50 percent of major work. This will nevertheless save you a lot of money.

Therefore, is dental insurance a worthwhile thing? Yes, when you want to preserve your smile and save money in the doctor office. It allows you to brush your teeth without likely incurring huge expenses in the future.

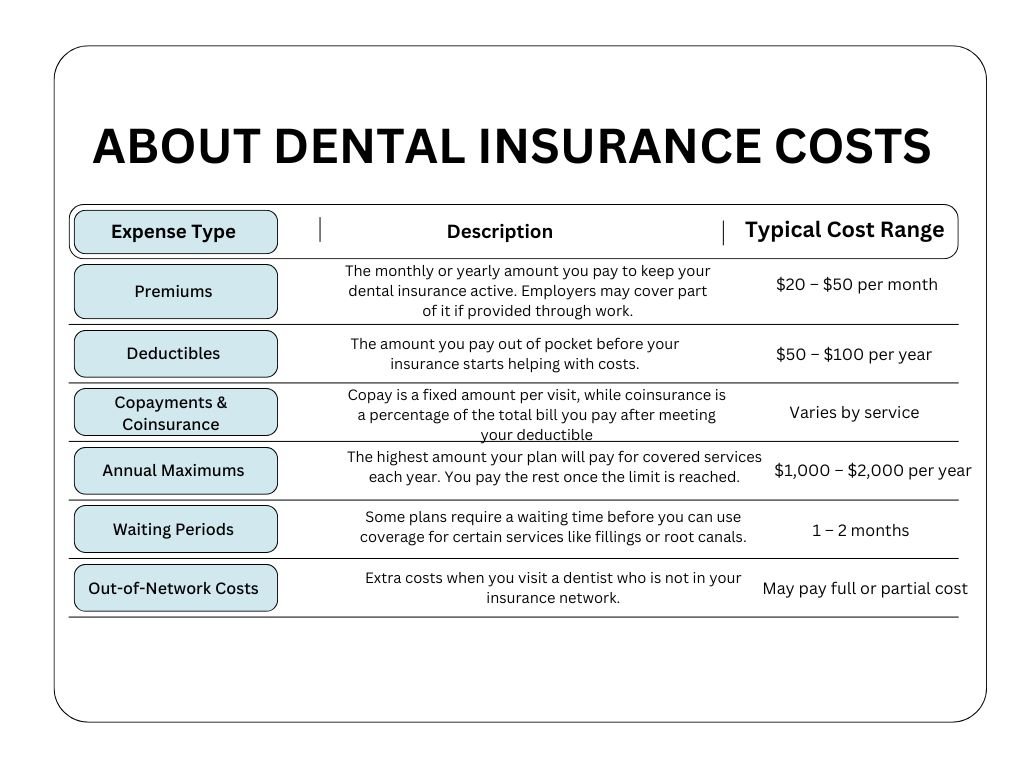

Not all people may have the same cost of dental insurance. It varies based on the type of the plan that you take and the extent to which it covers, and the source. You can purchase your personal plan, or your employment can provide it at a reduced cost. What are the key expenses you can pay?

Premiums: This refers to the amount of money you are paying every month or year to have your dental insurance in effect. The majority of the population pays between 20 and 50 dollars monthly. Provided that you get your plan on through work, it is possible that your boss will assist in paying some of it.

Deductibles: You must contribute a little amount of money before your plan begins to assist you in paying. This is called a deductible. It may cost as little as $50 to 100 per year as per your plan.

Copayments and Coinsurance: You can also pay a small amount per dentist visit, despite paying your deductible. Copay is a fixed amount that you are required to pay within a service whereas coinsurance is a fraction of the bill.

Annual Maximums: The majority of dental plans will only cover up to a certain amount annually, most frequently, it is between 1000 and 2000. In case your treatment is more expensive, you will be forced to pay the remainder.

Waiting Periods: There are other plans which require you to wait a month or two before you can use them in specific services such as fillings or root canals.

Out-of-Network Costs: When you visit a dentist who does not belong to the network of your plan, you might have to pay extra money or the entire price to him.

Should dental insurance be worth it then? Yes, when you go to the dentist on a regular basis or require major procedures, the insurance will save you quite a bit of money. Nevertheless, spending less without it is possible in case you do not go very often. You should always compare your needs and expenses to make a choice.

The price of dental services may vary depending on an individual. You do not know just how much you are going to pay. There are ones that are easy and inexpensive and others that are very expensive. That is why dental insurance can be of great assistance. It pays a portion of the bill thereby ensuring that you do not have to cover the whole bill.

To illustrate this, we will assume you are in need of a crown that can be purchased at about 1, 200 dollars. When you are insured in the dental field the cost can come down to approximately $900 since you will have a dental plan deal of lower rates with the network dentists. In case your plan covers half that cost then you will only have to pay 450 and it will be covered by the insurance. That is a saving of 750 dollars in a single visit!

Now consider it when the next big treatment like a root canal or you otherwise require later in the year, your expenses may increase by 1000 or more. It is then that dental insurance can come in and make a significant difference.

And therefore, is dental insurance worth being? Yes, as it will assist you save on huge dental bills, as well as provide you with peace of mind when you require care. It simplifies the process of taking care of your teeth without any doubt that they are expensive.

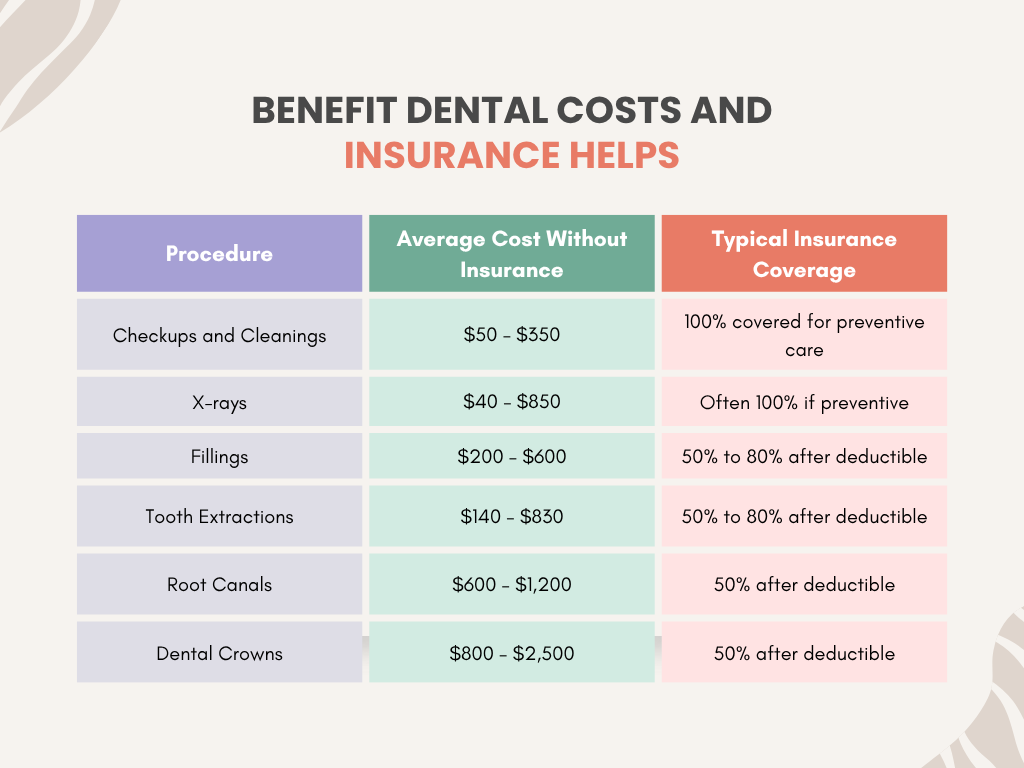

Dental care can be expensive, but having dental insurance can make it easier to pay for treatments. Here are some common dental procedures, their usual costs without insurance, and how much insurance can help you save.

Without insurance even the routine visits are expensive. A minor procedure can run several hundred dollars and more complex operations such as crowns or root canals can run into thousands. That is why so many people pose the question, is dental insurance worth it.

Under insurance, part of the cost can be paid by your plan, and hence reduce the out of pocket costs. As an illustration, a 1200 dollar crown can be insured at 600 dollars. By doing this, dental insurance will save you hundreds or sometimes thousands of money this year.

Dental insurance, therefore, is worth it? Yes, it makes you control your costs, keep your teeth healthy, and not to surprise yourself with unexpected bills. Insurance may cover the majority of the cost and make going to the dentist stress-free even in case of regular checkups and cleanings alone.

Dental insurance simplifies and lowers the cost of providing dental care. This would be very useful in case you are planning on your budget. When you have a dental plan, you tend to have full knowledge of what to expect when it comes to the amount of money you will spend on every kind of service. That way, you will not have to worry about the unexpected bills and you will be able to plan the entire year.

The dental insurance plan assists you to budget in a number of ways:

The question is, then, does dental insurance pay off? Yes! It can make you control expenses, budget on money and keep healthy. You will be able to take care of your teeth and do not think about big bills and unpredictable costs.

Dental insurance helps with many dental costs, but it doesn’t pay for everything. Knowing what is not covered can help you plan and avoid surprises.

Here are some things that dental insurance usually does not cover:

Even with these limits, dental insurance is worth it for routine care and emergencies. Reading your plan carefully will help you understand what is covered and what is not, so you can make smart choices for your dental health.

Dental insurance makes paying for dental care easier and more predictable. This is very helpful if you want to plan your budget. With a dental plan, you usually know exactly what costs to expect for each type of service. This way, you can avoid surprise bills and plan for the whole year.

Your dental insurance plan helps you budget in a few ways:

So, is dental insurance worth it? Yes! It helps you manage costs, plan your money, and stay healthy. You can take care of your teeth without worrying about high bills or unexpected expenses.

Dental insurance helps with many dental costs, but it doesn’t pay for everything. Knowing what is not covered can help you plan and avoid surprises.

Here are some things that dental insurance usually does not cover:

Even with these limits, dental insurance is worth it for routine care and emergencies. Reading your plan carefully will help you understand what is covered and what is not, so you can make smart choices for your dental health.

Is dental insurance worth it? Yes! It helps you pay less for the dentist. You can plan your money and avoid surprise bills. It may not pay for whitening, braces, or big extra costs. But it does help with checkups, cleanings, and major dental work.