Modified Whole Life Insurance offers coverage plus a wealth-building tool. The lower initial premium makes it easier to get started.

Want a permanent senior policy? Modified Whole Life Insurance may fit. With Modified Whole Life Insurance, you protect loved ones for life.

Modified Whole Life Insurance starts with low premiums. The first period often lasts two to three years. After that, the cost goes up. Modified Whole Life Insurance still offers lifetime coverage and cash value growth.

In traditional whole life, costs stay the same. Modified Whole Life Insurance begins with cheaper rates. After a few years, premiums rise. Both plans cover you for life.

Traditional whole life and modified life insurance differ in the following significant ways:

Early payments are smaller with Modified Whole Life Insurance. After a few years, they increase. Traditional whole life maintains the same rate throughout.

Modified Whole Life Insurance builds cash value with every premium. Early growth may be slower due to low starting payments. Traditional whole life may grow faster because premiums start higher.

Modified Whole Life Insurance gives financial security for your family. Premiums stay predictable, and coverage lasts as long as you pay. Cash value grows with your payments. Avoid hybrid products like AARP or Globe Life.

Modified Whole Life Insurance policies differ by company. Some wait two years, some three. Interest may start at 8%. If death happens, a $1,000 premium could pay $1,100. Plans vary for those with health concerns or limited underwriting.

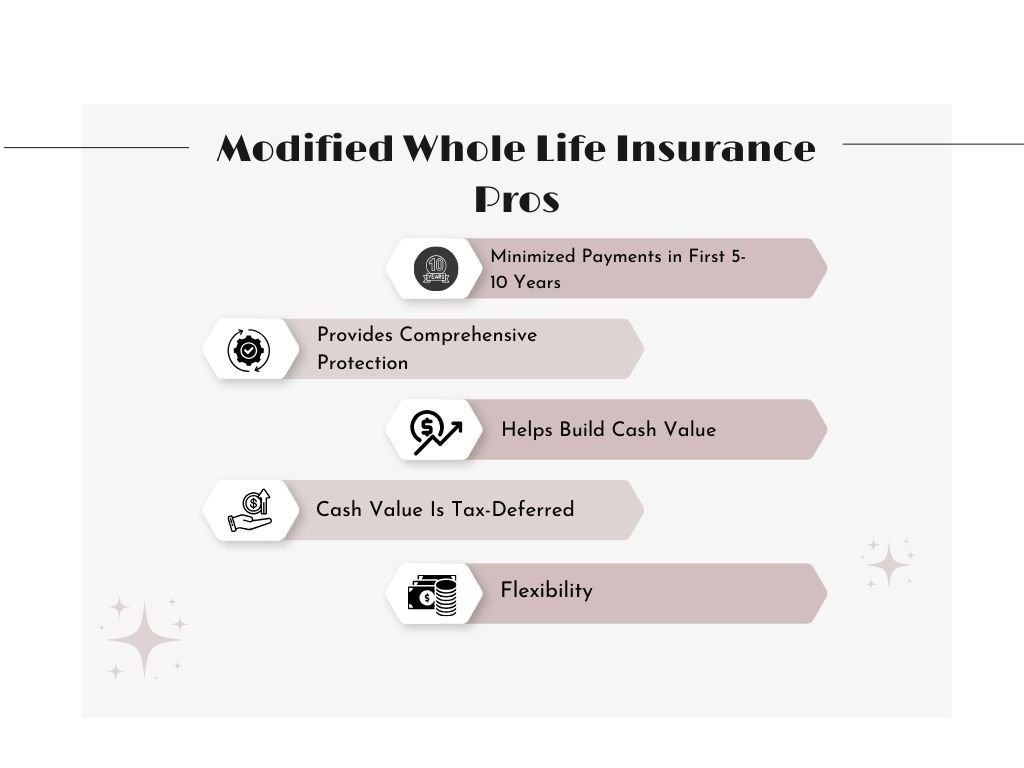

Many avoid whole life insurance because premiums last for decades. Modified Whole Life Insurance makes it easier. Early years have lower premiums. Later, rates increase. You can save cash for other bills.

Modified Whole Life Insurance gives protection for your entire life. Even if you pay only a few premiums at first, coverage continues. As long as you never miss a payment, you are safe.

With Modified Whole Life Insurance, your premiums grow cash value. Canceling doesn’t mean losing all payments. Some premiums can even be cashed out while keeping coverage.

Modified Whole Life Insurance lets your cash value grow tax-deferred. You don’t pay taxes until you invest or take profits. Your money grows without being taxed initially.

Modified Whole Life Insurance is more flexible than traditional life insurance. Premiums start low and rise after a set period. You can also customize coverage to fit your needs.

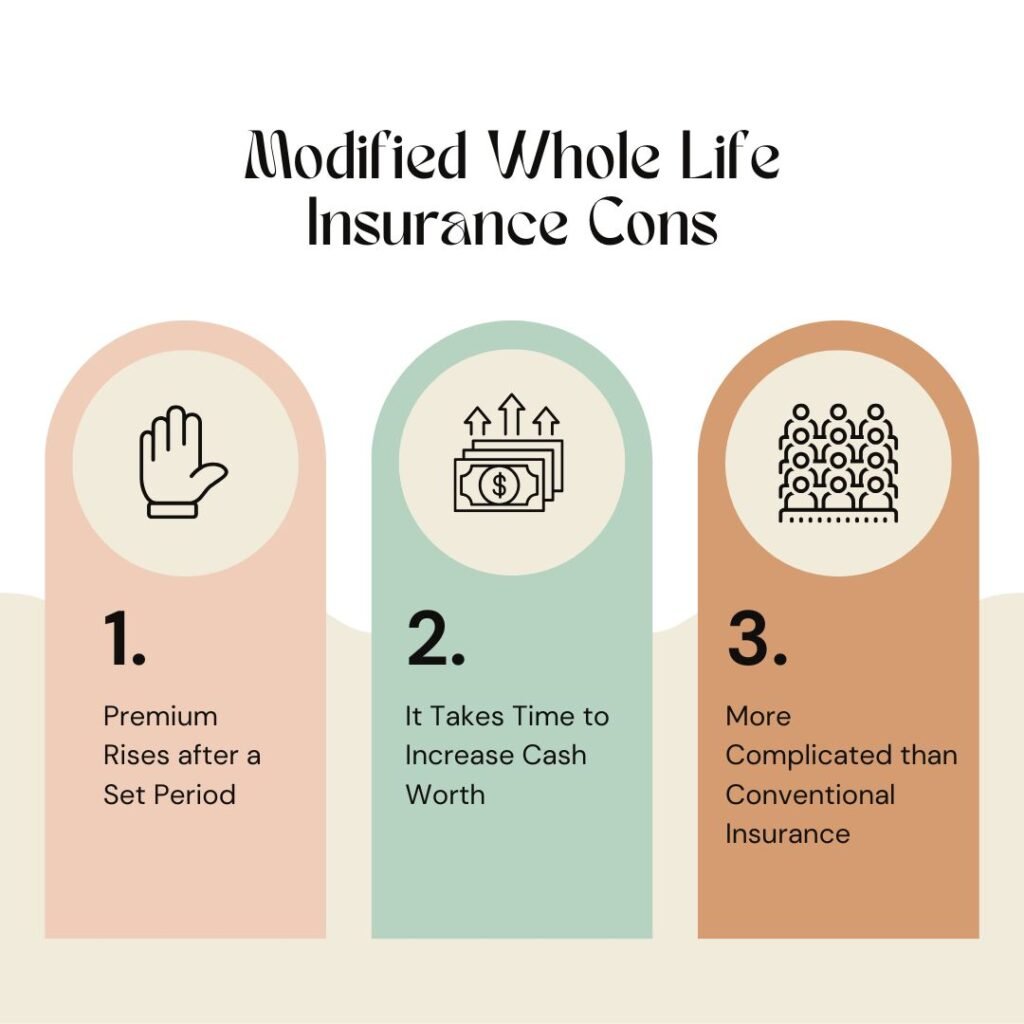

Some clients find Modified Whole Life Insurance confusing. Paying low premiums first and higher later may not make sense. They may prefer paying more early and less after 5–10 years.

With Modified Whole Life Insurance, you must pay premiums for many years to build cash value. This requires patience and financial commitment. Not everyone can manage this.

Modified Whole Life Insurance sounds great with many benefits. But it is more complex than it looks. It is harder to understand than traditional insurance.

When comparing Modified Whole Life Insurance with traditional whole life insurance, you will notice both similarities and differences. Many people confuse these two types of policies. It is important to understand them clearly. This helps you choose the right plan without mistakes.

Traditional whole life insurance is designed to provide coverage for your entire life. Once you take a policy, it will not expire as long as you pay your premiums. The policy only matures when the policyholder dies. At that time, the insurance company pays death benefits to your beneficiaries. Traditional policies require fixed premiums throughout the life of the policy. They also include a cash value component. This allows you to build savings over time. You can even withdraw some of your cash value if needed.

Modified Whole Life Insurance works similarly in that it covers you for life and builds cash value. However, the premiums are different. Early payments are lower during the first 5 to 10 years. After this period, premiums gradually increase. This structure makes it easier to manage payments in the beginning while still providing lifelong coverage. Like traditional policies, Modified Whole Life Insurance also builds cash value that you can access when needed.

Both traditional whole life insurance and Modified Whole Life Insurance are designed to provide lifelong coverage. They do not expire as long as you continue paying premiums. These policies also include a cash value component. This cash value grows over time and can be accessed when needed.

The main difference lies in the premium structure. Traditional whole life insurance requires you to pay the same premium amount for your entire life. This can be a financial burden for some people, especially in the early years of the policy.

Modified Whole Life Insurance is different. It allows you to pay lower premiums in the beginning, usually for the first 5 to 10 years. This helps you manage your budget and save money for other expenses. After the initial period, the premiums gradually increase. The total coverage and cash value benefits remain the same as a traditional policy.

This structure makes Modified Whole Life Insurance more flexible for people who need lower payments early on. It is ideal for those who want lifelong coverage but may not be able to afford high premiums immediately. The policy ensures protection while giving financial breathing room during the first years.

If you want flexibility in paying premiums during the early years, overfunded whole life insurance may be the right choice for you. Unlike traditional whole life insurance, which requires the same premium amount for the entire life of the policy, overfunded whole life insurance allows you to start with lower premiums. This makes it easier to manage your budget when you first take out the policy.

For the first 5 to 10 years, your payments will be lower than a traditional policy. This provides financial relief and lets you focus on other important expenses, such as bills or investments. After the initial period, premiums gradually increase to the standard level. Despite this adjustment, your coverage remains permanent, and the policy continues to build cash value over time.

The cash value of overfunded whole life insurance grows with each premium payment, just like a traditional policy. You can also access some of this value if needed, without canceling the policy.

This flexibility makes overfunded whole life insurance ideal for people who need lifelong protection but want lower payments at the start. It is a smart way to combine financial security with affordability, making it easier to maintain coverage over time.

Modified Whole Life Insurance is a type of permanent life insurance that provides lifelong coverage and builds cash value. Unlike traditional whole life insurance, it starts with lower premiums for the first 5 to 10 years. After this period, premiums gradually increase. This makes it easier to manage early payments while still offering long-term protection.

Both traditional and overfunded whole life insurance cover you for life and include a cash value component. Cash value grows over time and can be accessed if needed. However, modified policies grow cash value a bit slower at first due to lower starting premiums. Despite this, you still enjoy lifelong coverage and financial security for your family.

Modified Whole Life Insurance is flexible. You can tailor coverage to suit your needs. Early low premiums provide financial relief, while later adjustments ensure continued protection. Cash value is tax-deferred, allowing your money to grow without immediate taxes.

This insurance is ideal for people who want lifelong protection but need lower payments in the beginning. While slightly more complex than traditional policies, overfunded whole life insurance balances affordability with long-term benefits. It provides protection, cash growth, and flexibility, making it a smart choice for seniors or anyone seeking permanent coverage.