Getting protected today is easier than ever, yet many renters still ask, how long does it take to get renters insurance before signing a lease. The answer is surprisingly fast. In most cases, the renters insurance timeline can move from quote to approval within minutes thanks to digital insurance platforms and a streamlined renters insurance application process. Many providers even offer same-day renters insurance, allowing coverage to begin almost immediately after payment.

Whether you are relocating for work, preparing for move-in day or meeting a landlord requirement, understanding the timing helps you avoid last-minute stress. Knowing how fast can you get renters insurance ensures your belongings stay protected without unnecessary delays.

Renters insurance is a shield for your valuables and your wallet. It answers the question what does renters insurance cover by providing personal property coverage, liability coverage renters insurance and additional living expenses coverage if disaster strikes. This quick insurance process protects an insured tenant from costly property damage.

Timing matters because many leases include strict renters insurance requirements. You might ask, do I need renters insurance or is renters insurance mandatory. While not legally required in most states, landlords often demand it before keys change hands. Early planning prevents stress during your move-in date insurance phase.

| Coverage Type | What It Protects | Example |

| Personal Property | Belongings | Laptop stolen |

| Liability | Legal costs | Guest injured |

| Loss of Use | Temporary housing | Apartment fire |

So, how long does it take to get renters insurance in real life? The typical renters insurance approval time ranges from 15 to 30 minutes when you buy renters insurance online. Many renters insurance providers rely on an automated application with real-time quotes, making same-day renters insurance common.

However, the policy activation time can stretch if you add riders or show a complex insurance claims history. Providers such as State Farm and Progressive sometimes perform deeper risk assessment checks. Even then, most renters still secure coverage within hours.

Fact: The Insurance Information Institute (III) notes that renters coverage remains one of the fastest policies to obtain in the U.S.

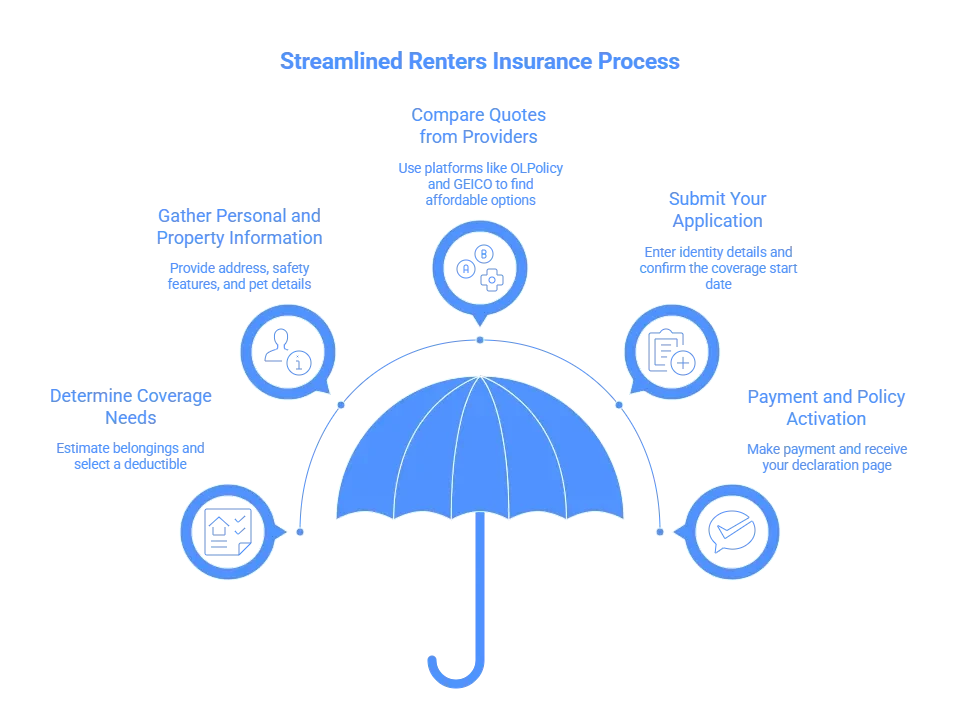

Picture the renters insurance timeline like a relay race. Each stage flows into the next through a quick insurance process, helping you understand what information is needed for renters insurance. Preparation speeds up the fastest way to get renters insurance while reducing friction during underwriting.

When you compare renters insurance quotes, focus on value rather than price alone. Strong insurance policy details ensure reliable theft protection, fire damage coverage and water damage protection.

Start by estimating belongings and selecting an insurance deductible that balances savings with risk. Think about electronics, furniture and jewelry. These decisions shape your insurance premium and prevent future surprises during claims.

Expect to provide your address, safety features, pets and prior claims. This insurance documentation allows the insurance carrier to finalize underwriting quickly.

Platforms like OLPolicy and GEICO offer fast comparisons. Checking several quotes ensures affordable renters insurance without sacrificing coverage.

Enter identity details and confirm the coverage start date. Accuracy avoids delays linked to the factors affecting renters insurance approval.

After payment, many renters receive a declaration page immediately. This document proves coverage and often includes options to add an additional insured such as a landlord.

| Step | Estimated Time |

| Needs Analysis | 2–5 minutes |

| Info Gathering | 5–10 minutes |

| Quote Review | 5–15 minutes |

| Application | ~5 minutes |

| Activation | Instant–24 hrs |

A common question is how long does it take for renters insurance to become active. Most policies activate on the chosen effective date renters insurance, sometimes within minutes. That flexibility helps renters align protection with lease deadlines.

Waiting periods rarely apply unless special endorsements are added. To secure same-day renters insurance, submit payment early and verify the coverage start date before checkout. This approach answers the popular query can you get renters insurance instantly with a confident yes.

The debate around renters insurance online vs agent often centers on speed. Using digital insurance platforms lets applicants buy renters insurance online through online insurance tools that deliver real-time quotes. Many finish the process during a lunch break.

Agents offer guidance, which helps when policies grow complex. Companies like Liberty Mutual and Farmers Insurance excel at tailored advice. Still, renters facing urgent deadlines usually prefer the online route for the fastest way to get renters insurance.

| Method | Speed | Ideal For |

| Online | Under 30 minutes | Urgent moves |

| Agent | Several hours | Custom coverage |

Several hidden elements influence how long does renters insurance approval take. Missing data or incorrect addresses slow the renters insurance application process. Buildings lacking alarms may raise concerns about vandalism coverage or guest medical expenses exposure.

Optional add-ons also stretch timelines. High-value riders demand deeper insurance underwriting and evaluation of insurance claims history. Staying organized shortens the renters insurance timeline dramatically.

Preparation turns chaos into clarity. Keep documents ready and follow proven advice on how to get renters insurance fast. Organized renters often get insured in minutes, especially when choosing providers offering instant renters insurance coverage.

Bundling policies unlocks insurance discounts bundling, lowering the renters insurance cost per month. Avoid rushed guesses about property value since underestimating can weaken financial protection during emergencies.

Quick Example: A Chicago renter completed the entire process in 18 minutes after uploading inventory photos.

Experts recommend securing renters insurance before move-in to eliminate coverage gaps. Asking when should I buy renters insurance becomes simple once you realize disasters ignore calendars. Early protection ensures your belongings stay covered from day one.

Life events also trigger policy updates. Marriage, relocation or expensive purchases increase risk. Reviewing your rental property insurance annually keeps coverage aligned with reality.

Landlords usually request proof of renters insurance before handing over keys. The fastest method involves downloading your declaration page, which summarizes coverage and confirms your status as a policyholder.

If urgency strikes, learn how to get proof of renters insurance quickly by accessing your insurer’s portal. Many systems send digital files within seconds, satisfying any landlord insurance requirement without paperwork delays.

Yes. Many providers approve policies rapidly, answering the query can you get renters insurance the same day with reassuring speed. The modern renters insurance quote time often lasts only minutes.

Most applicants wonder how long does it take to get renters insurance after applying. Approval typically happens within half an hour when details are accurate.

Policies often begin right after payment, though the chosen effective date renters insurance controls activation.

The average cost of renters insurance per month falls between $10 and $20, depending on location and coverage.

Coverage usually protects the named tenant only. Adding roommates requires listing them as an additional insured.

“Renters insurance remains one of the simplest ways to secure financial protection against life’s surprises.” — Industry insight based on data from the Insurance Information Institute (III)

Understanding how long does it take to get renters insurance transforms a confusing task into a predictable routine. The modern renters insurance timeline proves that strong protection no longer demands weeks of waiting. With preparation and the right provider, safety arrives faster than expected.

Need clarity on how long does it take to get renters insurance and want coverage without delays? The trusted professionals at OLPolicy are ready to guide you through the process, explain your options and help you secure protection that fits your lifestyle and budget.

Call (866) 757-5350 today or visit OLPolicy to get started with confidence.