Fort Lauderdale is one of South Florida’s most desirable coastal cities, known for beaches, high-rise apartments, walkable neighborhoods and scenic waterways. The lifestyle here attracts thousands of renters each year but coastal weather, humidity, and seasonal storms also bring unique risks. Affordable renters insurance in Fort Lauderdale, FL helps protect your personal items, cover unexpected losses, and provide financial support after sudden damage or accidents. This guide explains cost, coverage, exclusions, local requirements, hurricane-related considerations and how to choose a policy that fits your needs.

Renters insurance in Florida is designed to protect your belongings from multiple risks, including theft, vandalism and covered loss events such as fire or certain types of water damage. Fort Lauderdale renters face additional challenges from coastal storms, tropical systems, and high humidity levels that may affect housing conditions. While a landlord’s insurance may cover the building itself, the landlord’s policy does not protect your personal items or liability.

Renters insurance may also help cover personal items affected by smoke damage, wind-related incidents, or accidental events inside the home. For tenants living in a condominium, apartment, or rental home, this protection adds crucial stability in an unpredictable weather region.

The cost of renters insurance in Fort Lauderdale varies based on personal property limits, deductible choices, and neighborhood risk levels. Affordable renters insurance often ranges between $18 and $30 per month. Units close to the beach or in older structures may require higher premiums, while newer buildings with advanced safety features often qualify for discounted pricing.

Several factors influence the monthly price:

These pricing elements help tenants choose coverage options that balance affordability with protection.

Comparing quotes is the best way to secure an affordable policy. A renters insurance quote typically includes personal property protection, liability protection, and additional living expenses if the unit becomes uninhabitable. Tenants can request a free quote from insurers or get a renters insurance quote today using online tools.

Review the following during comparison:

Selecting coverage for your personal property at appropriate limits ensures you avoid out-of-pocket costs after unexpected events.

Renters insurance in Fort Lauderdale must account for coastal storms, strong winds, and seasonal hurricanes. Policies generally provide protection against wind damage, lightning, smoke, and vandalism. However, flood insurance is not included in standard renters insurance. Tenants living in high-risk zones may need a separate flood insurance policy to remain fully protected.

Some covered events include:

Tenants should also review exclusion sections related to neglect, wear and tear, or non-covered sources of water intrusion.

Insurance coverage typically includes three core protections:

Covers belongings like electronics, clothing, furniture, and personal items.

Items like jewelry may have internal limits, making additional optional coverages helpful.

Helps cover liability exposure if someone gets injured inside your home.

Included limits often start at $100,000 and can be increased.

Pays for temporary housing if the rental becomes uninhabitable due to a covered loss.

This protection helps pay for a hotel or a temporary place to stay.

These features help protect yourself and your belongings from costly setbacks.

Coverage limits apply to many categories, so reviewing your policy is essential. High-value items like jewelry, electronics, or collectibles may require scheduling additional coverage. Deductible selections also influence reimbursement amounts. The policy may also note exclusions for certain perils, so reviewing the exclusion section helps clarify expectations during claims.

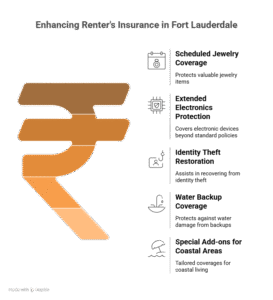

Many insurers offer optional coverages designed to expand protection:

Optional coverages help tenants customize their renters policy for items or situations not included in basic packages.

Insurance companies serving Fort Lauderdale evaluate coastal risks, building conditions, and neighborhood profiles. A local insurance agency can help tenants review coverage limits, deductible choices, and available discounts. Tenants may benefit by bundling renters and auto insurance from the same insurer, which often lowers premiums.

Some insurers also provide apartment insurance or condominium protection for specific living arrangements. Consulting a professional makes it easier to understand available options and receive guidance on policy structure.

Many property managers require renters insurance before move-in. Requirements typically include:

These rules help protect renters and reduce disputes after incidents.

Managing a renters policy involves reviewing limits annually, updating personal property values, and keeping digital copies of receipts or photos. Tenants may also use a personal property calculator to estimate the value of belongings. This helps ensure policy limits match the actual value of items inside the home.

Tenants can lower the cost of renters insurance by taking advantage of:

Using bundles can significantly lower costs and make coverage more accessible.

Many renters pair their renters and auto policies to reduce premiums. Auto insurance companies often offer discounts for combined policy structures. Bundling may cover liability protection needs more efficiently and offer additional price benefits.

Selecting the right deductible is essential. A higher deductible lowers your premium but increases out-of-pocket costs during a claim. Tenants should select a deductible that aligns with their financial comfort level. Deductible options typically range from $500 to $1,000 for local renters.

Flood insurance is essential for coastal renters. Standard renters insurance does not provide coverage for rising water, storm surge, or flooding. Tenants living in lower-elevation or waterfront areas can add flood insurance to ensure full protection. Reviewing water damage exclusions helps tenants understand which events are covered under standard protection.

The exclusion section lists events or damages that are not covered. Common exclusions include:

Understanding these exclusions prevents surprises during claims and helps tenants select additional protections if needed.

Choosing a policy involves evaluating personal property limits, deductible options, customer service ratings, and optional endorsements. Tenants can talk to an agent for professional support and compare several policies for reliability. Selecting reliable coverage ensures full protection during storm season and throughout daily life.

Affordable renters insurance in Fort Lauderdale, FL provides essential protection against theft, fire, water-related incidents, vandalism, and coastal risks. By selecting appropriate coverage options, reviewing exclusions, and choosing deductible levels that match your financial comfort, tenants can secure a policy that fits your needs and protects your personal items. With additional options such as flood insurance and bundling discounts, renters gain strong financial security in one of Florida’s most dynamic coastal cities.