Running a business costs money. Sometimes you may think, “Do we need cyber insurance? Or Is Cyber Insurance Worth It?” It can feel like an extra cost.

Many people say, “Our IT is done by another company,” or “We are too small to be a target.” But the truth is, every business can face cyber problems. Hackers do not only attack big companies. They look for weak points.

Cyber attacks are happening more often. They can cost a lot of money. Cyber insurance can help. It can pay for losses. It can also give help with data recovery and legal support.

Buying cyber insurance is not just a cost. It is an investment. It protects your business. It also gives peace of mind.

Good question!

Cyber insurance is a type of insurance for businesses. It helps when a cyber problem happens. It can pay for lost money, fixing computers, legal costs, and damage to your reputation. It can also cover fines.

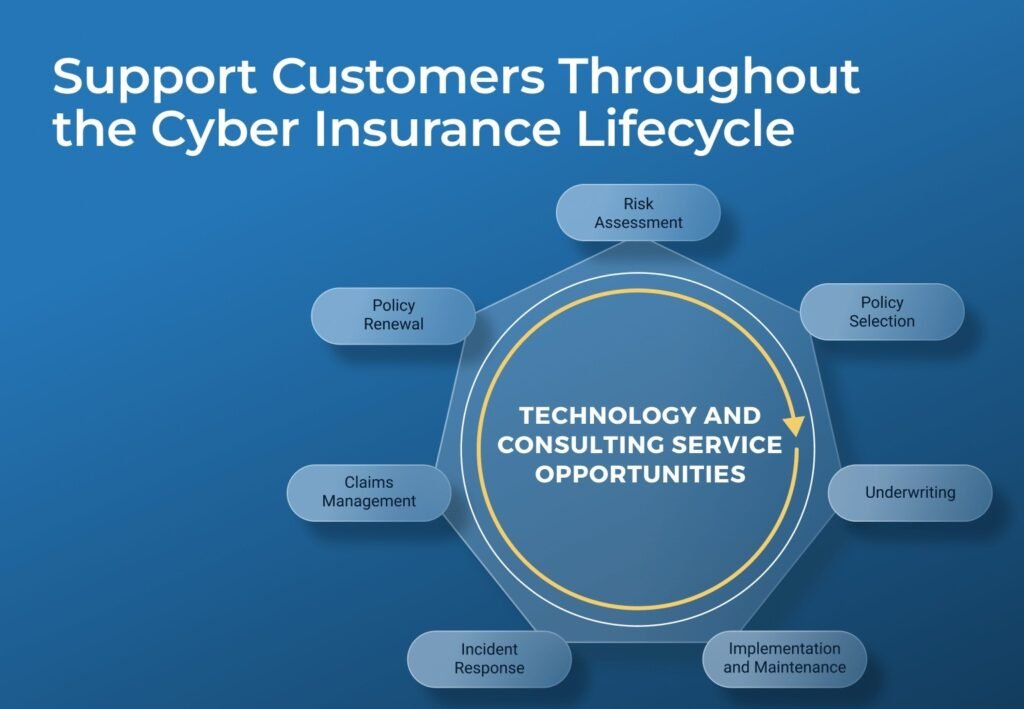

Some cyber insurance does more. It can help stop attacks before they happen. It may also be used to provide information on what to do in case of a cyber occurrence.

Cyber Insurance, then, is it worth it? Yes. It keeps your business safe. It helps you recover fast. It is an intelligent decision of a company.

Cyber insurance usually has two main types of cover: first-party and third-party.

First-party cover helps your business pay for losses you face yourself. This can include fixing your computers, restoring data, lost money, or ransom payments. It often comes with expert help to solve the problem fast.

Third-party cover protects your business if someone else takes legal action against you. This can happen if personal data is stolen or your system causes a problem for another company. It is able to cover legal expenses, damages and fines by regulators.

Is cyber insurance worth it? Yes. It defends your business against such large expenses and gives you speedy recovery in situations of cyber attacks.

Cyber insurance is beneficial to every business that is at risk of cyber-related attacks. It is near just about any business!

Not sure if your business is at risk? If you use computers for work, store data, or send money online, you should get first-party coverage. This helps you if your own systems are affected.

If your business handles sensitive client data or protects client systems, you should get third-party coverage. This helps if someone takes legal action against you.

It protects your business and your clients. It gives peace of mind and helps you recover fast from cyber problems.

Cybersecurity is very important. For two years in a row, it has been called the top business risk. 61% of small and medium businesses have had at least one cyber attack.

Companies should not only keep an eye on hackers. Regulations and legislations regarding information are increasing at an alarming rate. The GDPR provides stringent regulations on the management of data in Europe. Cyber laws are present in some states within the US. These rules will become more complicated as cybercrime continues to increase.

Despite this, it is only 10 percent of the businesses that use their IT budget to cover cyber security.

Better Together: Cyber Insurance and Cyber Security.

Cyber insurance does not substitute on cyber security. It works with it. The two work together in curbing cyber risks.

Imagine it to be property insurance. Alarms and sprinklers have been installed in buildings, insurance is also important. On-line security is similar to alarms and sprinklers. Cyber insurance provides your business with an opportunity to recuperate in case of something bad happening.

Is cyber insurance worth it, then? Yes. It secures your business and assists you to be back on track following a cyber attack.

Financial Protection

Cyber attacks can cost a lot. Businesses may face:

This is a big problem for any business. Cyber insurance helps share this risk with the insurer. It can cover losses from many types of cyber threats. This protects your business now and in the future.

Business Continuity

If your business stops working, you lose money, customers, and trust. A ransomware attack can stop a business for 24 days on average.

Good cyber insurance helps you get back to work fast. Some insurers have teams ready 24/7. They provide expert help before and after a cyber event. This gets your business online quickly.

Risk Management

Managing cyber risks is very important. Laws are changing, and cyber threats are growing. Many businesses have small budgets for cyber security.

Cyber insurance can help fill the gap. Some insurers also give free tools, like scanning systems, dark web monitoring, phishing tests, and expert advice. These tools help prevent attacks and respond quickly if one happens.

So, is cyber insurance worth it? Yes. It protects your money, helps your business run, and reduces risk.

It Comes With a Cost

Cyber insurance can feel expensive. Some businesses think it is not needed. But it offers real value.

The cost depends on:

The cost of a cyber attack is usually much higher than the insurance premium. With proactive help and coverage, cyber insurance is worth the money.

Limitations

Like all insurance, there are rules. Certain conditions must be met to claim. Choosing broad cover can reduce this risk and give peace of mind.

Cyber insurance can cover many risks, including:

But most policies do not cover:

So, is cyber insurance worth it? Yes. It protects your business and helps you focus on work instead of worrying about cyber risks.

Cyber insurance helps businesses. It protects from cyber attacks. It can pay for fixing systems, legal fees, ransom, and damage to reputation. There are two types: first-party for your own losses and third-party for legal claims from others.

Almost every business can use cyber insurance. Businesses that use computers, handle data, or protect client information need it most. It works best with strong cybersecurity.

The pros are money protection, keeping the business running, and reducing risk. The cons are cost and some limits on coverage.

Is cyber insurance worth it? Yes. It keeps your business safe and helps you recover fast.